Imagine this: a customer tries to repay their loan three times, fails each time, and misses the due date of repayment completion. This impacts customer experience and may result in customers being charged penal interest for not repaying the loan within the scheduled time frame without any fault of their own.

The Indian Non-Banking Financial Company (NBFC) sector is proliferating, with 9680 registered companies as of December 2021. While each of these NBFCs works hard and discovers best practices to create end-to-end digital journeys for their customers, most focus on loan origination journeys rather than all aspects of customer service.

By “extra mile,” we mean supporting the customer until the last phase of loan repayment when they don’t have to struggle with frequent payment failures and technological glitches.

An NBFC’s digital assets should have an inbuilt ability to route the customers to multiple payment methods, so if one fails, the customer is quickly routed to another.

Are all of these possible? The answer is – intelligent payment routing for the NBFC sector. In this article, we will explain payment routing, how it helps NBFCs and the best practices for payment optimisation.

Content Index

- What is an intelligent payment router?

- Why do NBFC merchants need an intelligent payment router?

- Best Practices for payment routing in the NBFC segment

- Challenges of implementing payment routering NBFC

- Why is Nimbbl the best intelligent payment routing solution in India?

What is an intelligent payment router?

A payment router defines the path to each transaction in a website or application. A multi-PSP (Payment Service Providers) payment router integrates a website or app with multiple payment gateways, banks, and similar financial sources to process the payment. A payment router’s function starts from the authorisation stage until the transaction routing stage.

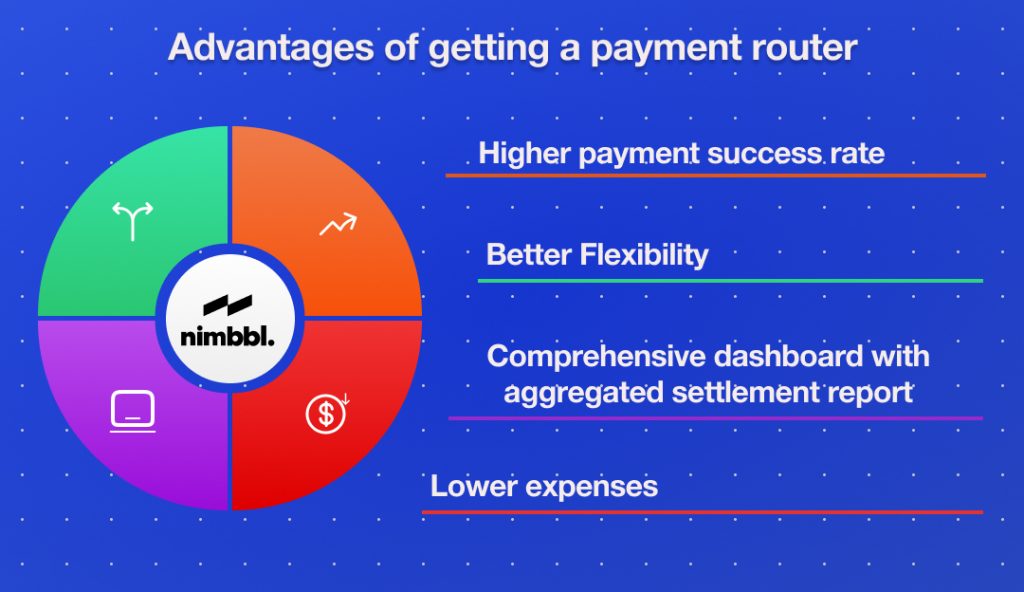

The key advantage of a payment router is you don’t need to opt for multiple payment integrations to connect with different PSPs. With just one integration, your websites/ mobile app or other customer-facing digital assets scale effectively routes customers to various payment gateways per their eligibility and speeds up transaction processing.

A payment router identifies the fastest and simplest payment route suitable for a customer to improve the possibility of payment completion and reduce drop-offs.

Here’s how a payment router works:

In the above example, suppose net banking is experiencing technical issues for aggregator one. In that case, the payment router detects this issue and directs the customer to the net banking of aggregator two to ensure transaction success.

Why do NBFC merchants need an intelligent payment router?

For NBFC merchants, there are peak periods for collecting loan repayment. These are pre-defined deadlines for paying the loans, exceeding which a certain percentage of penal interest may be charged to your customers.

During these periods, many transactions take place through your website or application. Though most of these payments occur through standing instructions, a payment router creates a failure-proof system to ensure that customers with repayment intentions don’t have to compromise on their experiences.

Consider adding new payment processing partners to your internal IT team. However, this is a long process, even for the beta version of your website, and it is also highly expensive.

That is exactly why you should opt for a payment router for your NBFC website:

- Relying on a single PSP increases the possibility of payment failure. NBFCs these days are integrating with one payment router to tie up with multiple payment service providers like net banking, credit cards, UPI, debit cards to backup existing payment providers and avoid redundancy

- A payment router is easier to set up. With just one integration, access multiple payment service providers to process payments faster during peak periods

- A payment router detects potential technical issues upfront to direct the customers toward a transaction path that increases the success rates for each transaction

- Intelligent payment routers have access to detailed transaction data to gain critical insights into payment optimisation

- Payment routers come with a comprehensive dashboard that provides an aggregated transaction report, facilitating all transaction and customer service operations from a single place.

NBFCs are creating an end-to-end digital journey for customers to simplify onboarding and loan disbursement. Then why not optimise the last mile of loan repayment without adding frontend complications for their customers?

Best Practices for payment routing in the NBFC segment

Here’s how to establish payment optimisation with payment routing:

Set clear goals in terms of number of transactions

Setting realistic transaction goals is a good starting point for implementing payment routing. For example, identify the minimum threshold of transactions required to enable the payment router. Once your targeted transaction volume is reached, start routing once daily, weekly, or monthly.

Use a payment router with high-security

routing protects sensitive information with encryption. This encryption standard protects valuable content throughout the transaction, maintains confidentiality, and prevents unauthorised access.

Since NBFC merchants deal with critical financial and asset information, an SRT-based routing helps them build a secure payment processing environment to protect sensitive information.

Keep refining the payment routing logic

Monitoring transaction volumes per payment method determines the most profitable transactions as well as the most popular payment methods. Track payment KPIs like authorisation rates, average transaction processing time, and transaction failure rates to collect data related to the effectiveness of your current payment router.

This will help you optimise your transaction processing further by refining the routing logic regularly.

Challenges of implementing payment routering NBFC

Implementing payment routing comes with its share of challenges. Multiple PSPs are involved in the process, and you must deal with numerous integrations, fees, and specificities. Different PSPs opt for different data reconciliation formats, and decoding these reports to create one uniform reconciliation statement is tricky.

Additionally, some PSPs restrict the movement of card data, making it difficult for NBFCs to switch between different payment service providers efficiently.

For NBFCs, build vs. buy is not an option for intelligent payment routing.

NBFCs should instead focus on creating more straightforward digital journeys using the best possible payment routing platform, like Nimbbl.

Why is Nimbbl the best intelligent payment routing solution in India?

Nimbbl, an intelligent payment router, is one of India’s most popular online payment gateway aggregators. Here’s why it stands out in the crowd of multiple payment routing solutions:

One integration to access the all-in-one dashboard

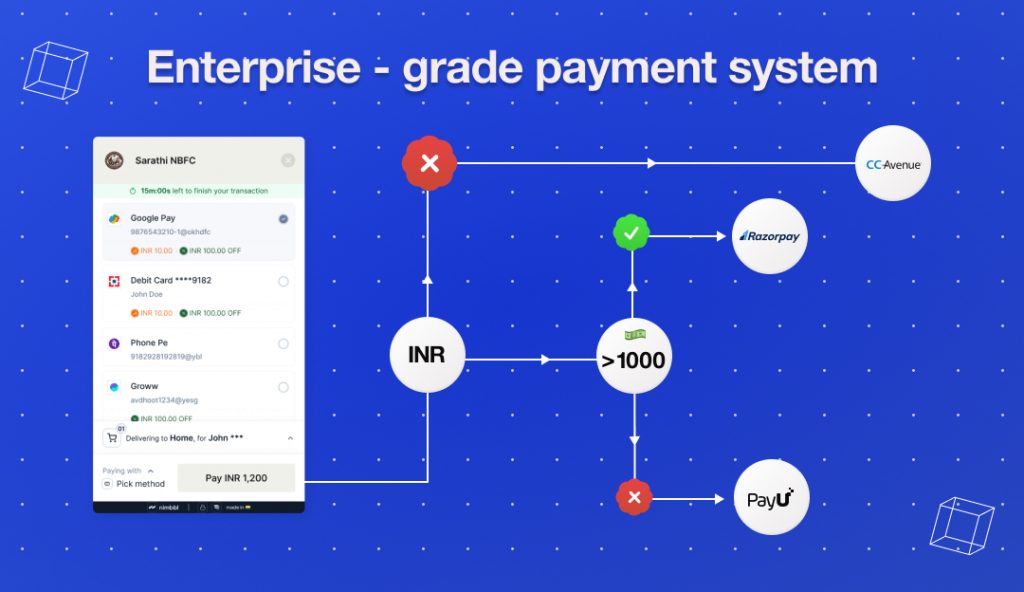

Integrating Nimbbl into your NBFC website/application lets you access the top payment aggregators of your choice, like PayU, Razorpay, Worldline, CCavenue, BillDesk, etc. Adding or removing PSPs, switching between them, and changing priority is simpler than ever.

With Nimbbl, you can save on payment processing costs and only pay for your desired use cases. Nimbbl’s extensive dashboard also provides an aggregated settlement report to interpret payment trends.

Create enterprise-grade payment experience for businesses of all sizes

Build a payment experience that matches top and new-age NBFCs in your segment. Create a smooth checkout experience, backup payment aggregators, simplify routing to multiple PSPs and allow higher transaction limits without worrying about your payment routing collapsing midway.

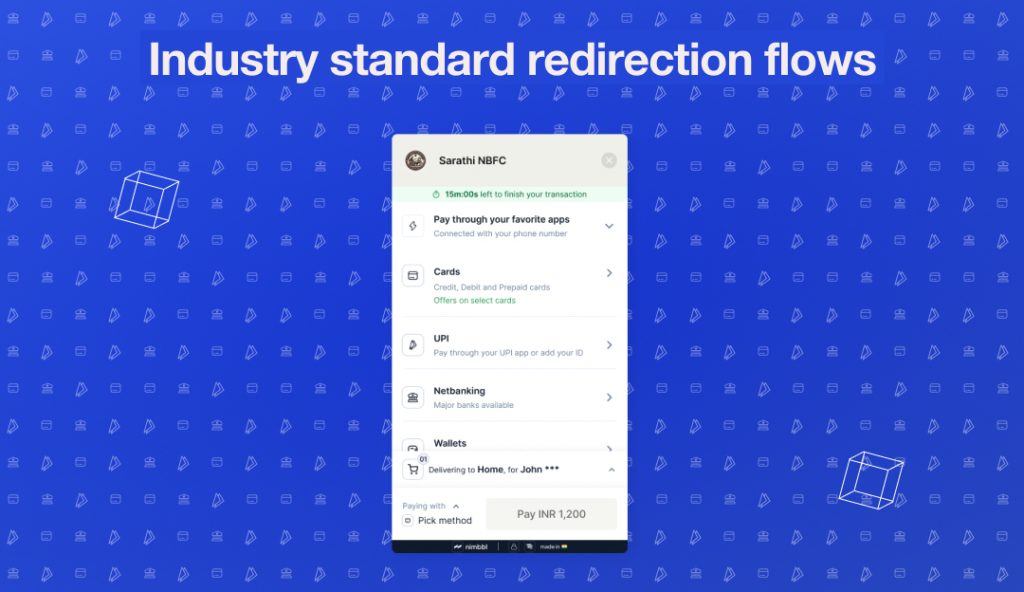

Industry-standard redirection flows

Nimbbl’s built-in redirection flows are per industry standards and preferred by new-age customers. Additionally, Nimbbl offers all the payment methods that today’s Indian customers seek, including UPI BNPL – all with a single API. These ready-to-use payment flows empower your NBFC website to perform A/B tests better and decide payment flows in a data-backed way.

Bonus: One-click checkout experience for up to 20% boost in sales

Nimbbl’s one-click checkout solution speeds up the checkout experience to boost conversion, reduce cart abandonment, and increase repeat purchases – to build a loyal customer base.

Ready to get an intelligent payment routing for your NBFC website?