| TL;DR 1. Single payment partners work fine until you hit high transaction volumes 2. Adding radio-button gateway choices doesn’t solve underlying performance issues 3. Intelligent routing automatically selects the best provider for each transaction 4. Benefits include backup protection, better success rates, and simplified operations 5. Nimbbl provides single integration to 15+ Indian providers |

Your marketing campaigns are working. Traffic is converting. Customers are ready to buy. But as your business grows, you’re starting to notice payment hiccups during high-traffic periods that weren’t there when you had 50 orders a month.

Maybe your current payment partner occasionally struggles during festival sales, or you’ve noticed certain bank combinations don’t perform as well as others. You’re considering adding another payment option to your checkout page, but simply giving customers multiple gateway choices won’t solve the underlying challenges.

Many Indian business owners face growth-stage payment challenges during peak seasons, often turning to social media posts for technical support on paid services. The question isn’t whether your current setup is wrong – it’s how to evolve your payment infrastructure as your business scales.

This article explains how intelligent payment routing creates the reliability and performance improvements your growing business needs, without the complexity of managing multiple separate integrations.

Content Index

- When single payment partners reach their limits

- What multi-gateway integration actually means

- The real benefits you’ll see immediately

- How Nimbbl Makes this Simple

- What’s Next?

When single payment partners reach their limits

As your business grows from processing dozens to hundreds of transactions daily, the payment infrastructure that got you started may not be sufficient for your scaling needs.

Why most businesses start with one partner

Most Indian businesses start with a single payment partner because it feels logical. You’re bootstrapping, focused on getting your first sales, and one integration gets you accepting payments quickly. Razorpay, Paytm, or PayU – pick one, integrate once, and you’re live.

Growth-stage challenges that emerge

But as your business scales, new challenges surface. Picture this: during a Diwali sale, your electronics store processes 3x orders in the first hour, then your payment partner starts throwing timeout errors.

By the time support responds six hours later, you’ve lost ₹3.8 lakh in potential sales. Payment partners in India mention transaction failure rates of up to 30%, with failures happening due to network issues, bank downtimes, or fraud detection systems blocking legitimate transactions.

Specific Indian context

Different providers perform differently with various banks – while your current partner might work smoothly with HDFC customers, it could struggle with SBI or ICICI transactions. During festival seasons when UPI traffic spikes, some providers handle the load better than others, leaving businesses scrambling when they need reliability most.

Impact on growing businesses

The impact goes beyond immediate lost sales. Research shows that 62% of customers who experience a failed online transaction will not return to the same website to try again. You’re not just losing one transaction – you’re potentially losing that customer forever, along with their lifetime value and word-of-mouth referrals.

What multi-gateway integration actually means

When businesses recognize they need payment alternatives, the first instinct is often to add multiple payment options to their checkout page. But simply giving customers radio buttons to choose between different providers doesn’t solve the underlying challenges.

Why multiple payment options aren’t enough

Adding PayU, Razorpay, and Paytm as separate checkout options seems logical, but this approach has severe limitations. Customers don’t know which provider works best with their bank or payment method.

They might select an option that’s experiencing downtime or poor performance with their specific transaction type. By the time they discover the payment failed, they’ve already gone through your entire checkout process and may abandon the purchase entirely.

Beyond the selection problem, radio-button approaches create operational complexity that compromises customer experience across channels. While you might implement multiple gateway options on your main website, extending this to payment links, mobile apps, or social commerce channels becomes cumbersome.

Each touchpoint requires separate integration work, different UI implementations, and varying customer experiences. Customers paying through your Instagram link receive different options than those using your mobile app, leading to inconsistent brand experiences and operational headaches for your team.

Simple explanation without jargon

Proper multi-gateway integration means connecting several payment processors through one unified system that makes intelligent decisions automatically. Instead of juggling multiple dashboards, APIs, and reconciliation processes, you get a single interface that manages everything behind the scenes.

How it works from the customer perspective

Your customers see no difference. They click “pay now,” choose their preferred method, and complete the transaction. What they don’t see is your system automatically selecting the provider most likely to process their specific payment successfully.

A customer using HDFC UPI might get routed through Provider A, while someone with an SBI credit card gets processed through Provider B – all invisible to them.

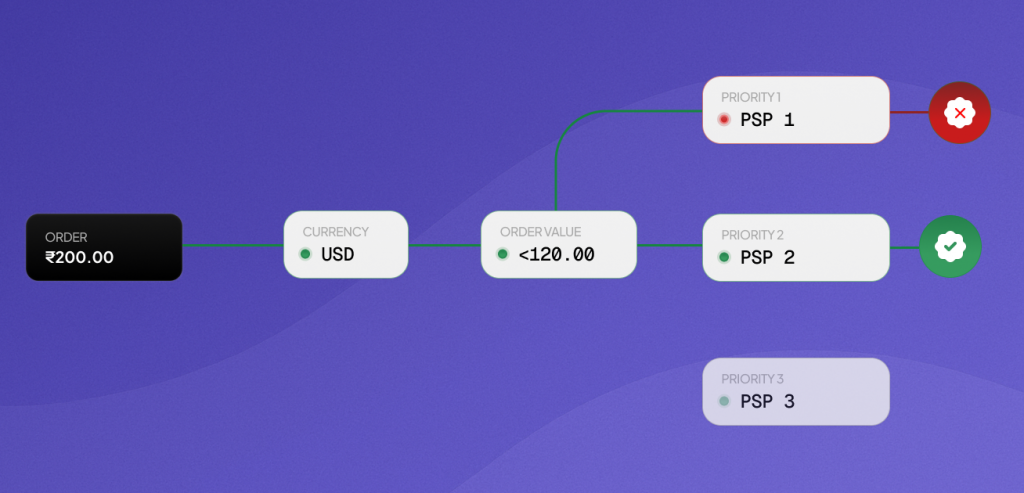

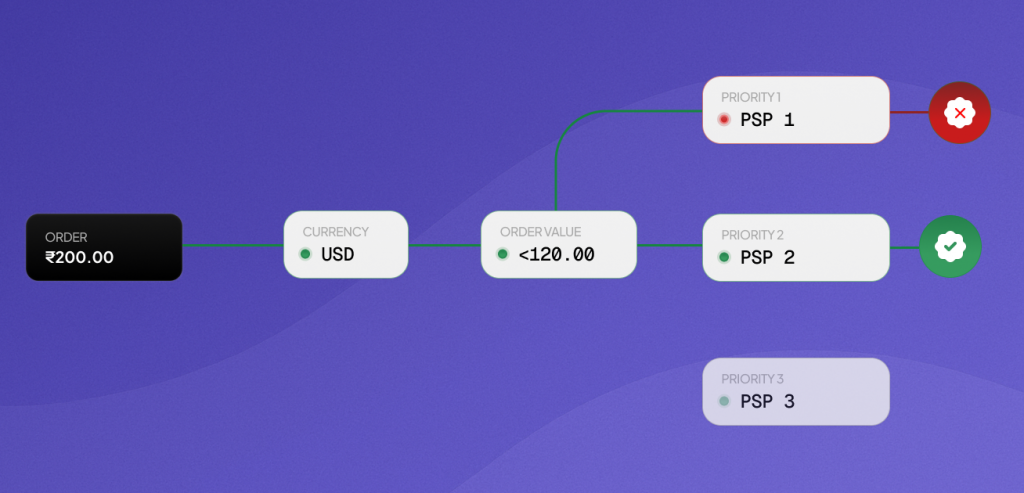

Why intelligent routing matters more than just having options

Having options without intelligence is counterproductive. True integration includes intelligent routing that automatically directs each transaction to the provider with the highest success probability for that specific payment type, bank, and current performance conditions. It’s not just backup – it’s optimization for every single payment.

Single Gateway vs Multi-Gateway Comparison

| Single Gateway Approach | Multi-Gateway Integration |

| One integration, one point of failure | One integration, multiple backup options |

| Accept the provider’s average performance | Optimize each transaction automatically |

| Manual intervention during outages | Automatic failover protection |

| One dashboard, limited insights | Unified dashboard with comprehensive analytics |

| Provider-specific bank limitations | Best-performing provider per bank/payment type |

The real benefits you’ll see immediately

Once you implement multi-gateway integration, the changes become apparent within your first week of operation. These aren’t theoretical advantages – they’re measurable improvements to your bottom line.

Reliability that protects your revenue

When your primary gateway goes down during peak hours, your backup systems kick in automatically. No more watching helplessly as sales disappear while you wait for support tickets to get resolved.

During the major UPI outage in April that affected millions of transactions across India, businesses with multi-gateway setups continued processing payments normally while their competitors lost entire days of revenue. Your system becomes antifragile – it doesn’t just survive problems, it continues functioning seamlessly through them.

Better success rates

Intelligent routing analyzes each transaction in real-time and directs it to the gateway with the highest probability of success. Different gateways achieve varying success rates with various banks and payment methods – some excel at HDFC transactions, while others handle SBI payments better.

Instead of accepting your current gateway’s average performance, you get the best possible outcome for each transaction. Businesses typically see 15-25% improvement in overall success rates within their first month.

Customer satisfaction

Indian customers have strong payment preferences that vary by region and demographics. Mumbai customers might prefer credit cards, while Pune users favor UPI, and tier-2 city shoppers often choose net banking.

A multi-gateway system ensures optimal performance across all these preferences. When customers can pay using their preferred method without encountering failures, they complete purchases and return for more. No more frustrated customers abandoning carts due to payment errors.

Simplified operations

Instead of logging into three different dashboards, checking multiple reconciliation reports, and managing relationships with several support teams, you get one unified interface. Your finance team spends minutes instead of hours on payment reconciliation.

When issues arise, you have one point of contact instead of playing phone tag between different gateway providers. This operational simplification frees up significant time for growing your business instead of managing payment infrastructure.

Multi-gateway systems also provide natural expansion capabilities for international sales and typically improve overall conversion rates by 8-12% through reduced checkout friction. Still, the four benefits above deliver the most immediate and noticeable impact on your daily operations.

How Nimbbl Makes this Simple

The challenge isn’t avoiding single integrations – it’s choosing the correct type of single integration. There’s a fundamental difference between depending on one payment provider and connecting to an intelligent routing platform that manages multiple providers behind the scenes.

Single integration to multiple capabilities

When you integrate with Nimbbl, you’re not creating another single point of dependency like a traditional payment partner. Instead, you’re connecting to a system that automatically distributes your payment processing across multiple proven providers.

If one provider experiences issues, your transactions continue flowing through others without any intervention from you. This is fundamentally different from putting all your payment processing through one provider’s infrastructure.

Why does this approach reduce risk instead of increasing it

Traditional single-provider dependency means that when their system has problems, your payments stop. With Nimbbl’s approach, your payment processing becomes more resilient because it’s distributed across multiple providers. We handle the complexity of monitoring performance, managing relationships, and optimizing routing so you get the reliability benefits without the operational overhead.

Key gateway partners are working together

Nimbbl connects you to India’s leading payment processors, including Razorpay, PayU, Cashfree, CCAvenue, Paytm, PhonePe, HDFC PG, and Pinelabs. These aren’t just technical connections – they’re optimized relationships where each provider handles the transaction types and customer profiles they perform best with.

India-specific optimization

Our routing algorithms understand Indian banking patterns, festival season traffic spikes, and regional payment preferences. When a customer from Bangalore uses PhonePe, or someone from Delhi pays with an ICICI credit card, Nimbbl automatically routes to the provider that performs best for that specific combination.

Real business impact

Businesses using Nimbbl typically see payment success rates improve significantly within their first month, with even higher improvements during peak seasons when traditional single providers normally struggle most.

What’s Next?

Payment failures shouldn’t control your revenue potential. Every day you delay means more lost sales and frustrated customers who might not return.

Ready to protect your business from the vulnerabilities of a single gateway?

Schedule a conversation with Nimbbl’s payment experts to see how multi-gateway integration can secure your revenue stream and improve customer experience.