Most customers now expect UPI at checkout.

While UPI usage is rapidly increasing, maintaining high UPI transaction success rates has become increasingly challenging.

Suppose a customer is ready to make the final payment, chooses UPI, but the payment gets declined due to checkout glitches, downtime, or latency issues. Result? Frustrated customer, abandoned cart, and a potential lost sale.

That’s why improving success rates for UPI-based payments is no longer optional. It’s essential for increasing conversions and winning customer trust. So, read on to learn more about why UPI payment success rates matter and what you can do to improve these success rates.

Content Index

Why UPI Success Rates Matter?

UPI is no longer just another payment option.

With the growing volume of UPI transactions, you must offer the UPI payment mode and ensure that payments are processed successfully. In fact, according to NPCI UPI Statistics, July 2025 recorded 19,467.95 million UPI transactions, amounting to ₹25,08,498.09 crore in value. Whereas, in June 2025, 18,395.01 million transactions worth ₹24,03,930.69 crore were recorded. This confirms a significant month-over-month increase.

This means that most customers prefer to pay via UPI, and any drop in success rates directly hits conversions. Issues such as latency or server glitches can stall payments, resulting in increased support queries for pending transactions. And if transactions fail, it will result in abandoned carts, lost revenue, and frustrated customers who may even choose to purchase from a competitor’s brand.

Simply put, to boost conversions and reduce cart abandonment, you must ensure a higher UPI-based payment success rate. But how? Let’s discuss.

Ways to Improve Success Rates for UPI-Based Payments

A 2024 survey data suggests that 15% of people use UPI for online shopping. That means, if you don’t improve your UPI success rates, you risk losing 15 out of every 100 customers.

With the increasing number of UPI users, it is essential to adopt practices that enhance the success rates of UPI-based payments. Here are a few:

Choose error-proof UPI checkout flows

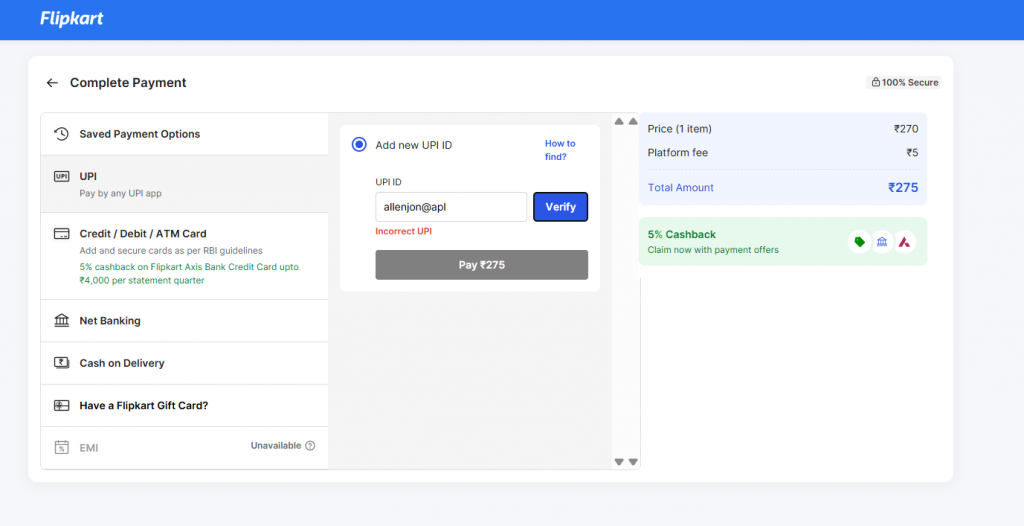

Keeping UPI checkouts fuss-free and guided helps drive higher success rates. For example, validating the UPI ID before the transaction progresses helps identify errors early and reduces declines due to typos. Additionally, using SDKs to maintain user context makes UPI checkouts seamless.

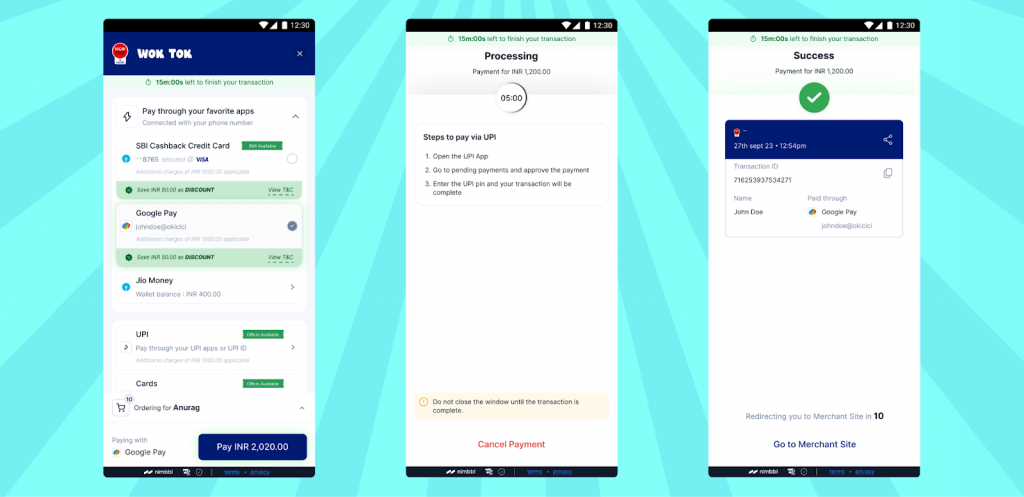

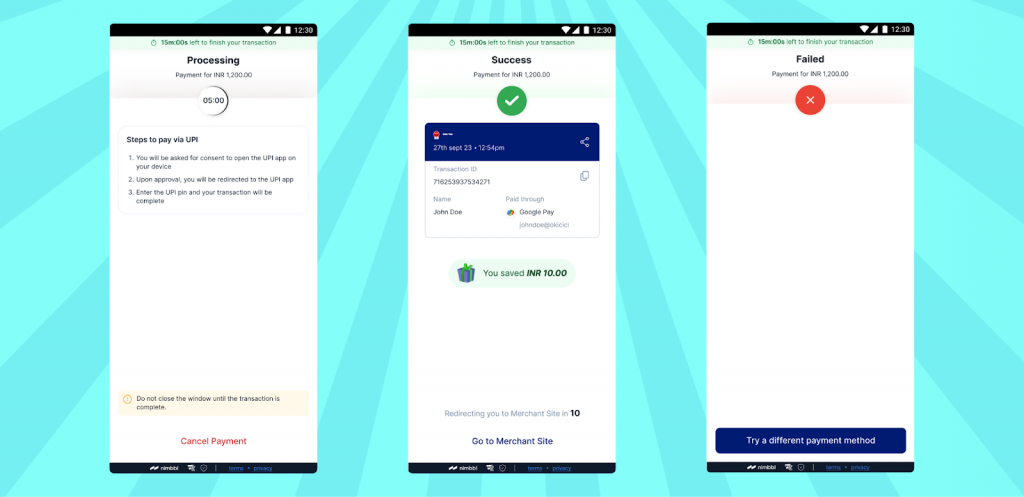

With intent flows and SDK-based checkouts, you can send payment details directly to the UPI app while preserving the customer’s order context. Once the payment is done, the customer is redirected back to your app or website with purchase confirmation.

🔖Here are some checkout best practices to follow: Checkout Page Designs & Best Practices

Enable intent flow and dynamic QR for UPI

With UPI intent flow, users don’t need to type out their VPAs or UPI IDs manually. The intent flows directly to open their UPI app with payment details auto-filled. This reduces error and speeds up checkout. Additionally, when you support QR codes, customers can simply scan the QR, and with the exact transaction amount generated at checkout, the possibility of manual errors is reduced.

However, intent calls can sometimes break due to device-level settings (like default UPI apps or OS restrictions). Without robust technical implementation, this may lead to failed redirections or stuck payments.

Using platforms like Nimbbl ensures you’ve optimised technical processes that make QR codes and intent flow implementation seamless. While Nimbbl auto-fills UPI IDs, it also allows you to offer QR codes for payment, ensuring minimum errors, faster checkouts, and higher payment success.

Pre-validate VPA and enable numeric mapping

Before accepting a payment, verify the UPI ID (Virtual Payment Address) to minimise failures from typos or wrong entries. Additionally, you can implement numeric mapping, which allows users to simply enter the phone number and have UPI IDs mapped automatically. This will ensure they don’t have to memorise their UPI IDs and reduce errors.

Here’s how Flipkart uses VPA verification to ensure the UPI ID entered is correct.

Leverage dynamic routing

When you implement a payment system with dynamic routing, it automatically directs UPI transactions in real time to the payment gateway with the highest probability of transaction success.

Nimbbl’s dynamic routing feature tracks payment gateways that perform the best at any given moment. It automatically directs transactions to those gateways to increase the transaction success rates. This means if Payment Gateway A’s success rate drops from 95% to 60%, the transaction will be directed to a better-performing gateway. The result? More successes, fewer declines.

🔖Read more about payment gateway failures: Why Indian Businesses Can’t Afford Single Payment Gateway Failures?

Monitor UPI transactions in real time and flag issues

UPI transactions can fail due to bank downtimes, NPCI throttling, or device-level issues. By monitoring UPI transaction flows in real-time, merchants can quickly identify high failure rates from a particular bank or PSP and redirect traffic as needed using a UPI router.

To improve payment success rates, check transaction success rates, conversion rates, uptime, chargeback rate, and more on the dashboard. Additionally, you can set up alerts for significant drops in success rates or spikes in transaction failures.

Minimise checkout time and input errors

22% of cart abandonments happen due to longer and complex checkouts. The longer the checkout time, the higher the possibility of customer frustration, input errors, and transaction timeouts.

By minimising checkout time and utilising VPA validations, you can improve UPI transaction success rates. Nimbbl’s Magik UPI auto-fills saved VPAs or pre-fetched IDs, reducing input errors and minimising checkout time. It also ensures faster and successful payments with pre-built Nimbbl checkouts or via APIs.

Provide a transparent UX to reduce confusion and duplicates

Guide users throughout the checkout and payment process. Use clear messaging, such as “Redirecting to [App]” and “Payment pending”, and inform users immediately about transaction success and failures. This helps prevent double transactions and also stops customers from making multiple payment attempts while the transaction is in progress.

Leverage a multi-payment gateway solution

Putting all your transactions through a single payment gateway is risky. If that gateway experiences downtime or latency issues, the rate of failed transactions goes up. As a result, you experience more abandoned carts and revenue loss.

Using a multi-payment gateway solution ensures high UPI payment success rates, specifically during peak hours. They prevent overloading one gateway and automatically route transactions to gateways with higher transaction success rates. Plus, you can offer multiple payment methods to your customers for convenience.

Take Nimbbl, for example.

Nimbbl is a multi-payment gateway solution that connects your store to multiple payment processors through one integration. This way, if one gateway is down, another takes over instantly, ensuring higher reliability and smoother checkout experiences.

Nimbbl offers a unified platform that integrates with multiple payment gateways, such as PayU, Cashfree, CCAvenue, Pine Labs, Easebuzz, Billdesk, and PhonePe. Hence, you can offer customers multiple payment modes and ensure secure and efficient checkout.

Here’s a quick look at the benefits of Nimbbl’s multi-payment gateway solution:

✅Wide payment method coverage: Offer a variety of payment options, making it easy for customers to pay via their preferred method—from debit/credit cards, UPI, digital wallets, to BNPL.

✅Improved reliability: Reduce the chances of transaction failures due to downtime from a single gateway. If there are issues with one gateway, your customers can still make payments without disruption.

✅Global reach: If you’ve a global customer base, Nimbbl makes it easier to accept international payments by providing gateways that support multiple currencies.

✅Simplified payment management: With Nimbbl, you can manage all payments under one platform. That means saved time, less effort, and no multiple integrations.

🔖Check out why multi-payment gateway setup is a must for high-growth businesses.

Conclusion

UPI is one of the leading digital payment channels, most preferred by customers for its convenience. To reduce cart abandonment and increase revenue, consider adopting various practices to enhance UPI payment success rates.

From error-proof checkout flows, multiple payment options, to leveraging real-time monitoring and dynamic routing, Nimbbl helps you with everything.

With Nimbbl, you can ensure seamless checkout with Magik UPI and multi-payment gateway integrations. This will ensure faster, frictionless, and more reliable UPI experiences to customers.

Want to learn more about Nimbbl?