Every eCommerce store owner dreams of providing a frictionless checkout experience with a “Payment Successful” message for each customer.

But how often does that happen? Not too often, considering the cost of failed payments globally was $118.5 billion as of 2020.

For eCommerce stores, an unsuccessful transaction leads to customer dissatisfaction, potential lost sales, and abandoned carts.

All these point to finding ways to increase the payment success rate for your eCommerce store by reducing the common payment problems.

This article will discuss the factors hindering successful payment and how eCommerce merchants can improve the number of successful transactions with the right tips and payment gateways.

Content Index

- What do you mean by a successful payment?

- What are the most common reasons for transaction failures?

- Best practices to reduce the number of failed transactions on an eCommerce website

- How to handle failed payments for your eCommerce store?

- Which payment gateway is most successful for ensuring successful transactions?

What do you mean by a successful payment?

A successful payment occurs when the customer follows an efficient and secure transaction process to complete their checkout and place an order without any friction.

To define a successful payment for an eCommerce store, you must know the concept of payment success rate.

Payment success rate refers to the percentage of successful payments out of the total number of attempted payments in your online store. For example, if 100 payments were attempted and 80 were successfully processed, your payment success rate is – 80%.

Payment Success Rate = (Number of successful transactions/ Total number of attempted transactions) * 100 |

The more “payment successful” messages you receive, the higher your payment success rate.

The payment success rate indicates how seamless your checkout experience is; hence, it is a critical metric to track. A higher payment success rate means a large base of satisfied and returning customers, a higher repeat purchase rate, and more revenue generation.

Lower payment purchase rates mean issues like payments deducted from customers’ banks but orders not placed, leading to abandoned carts and frustrated customers who hardly ever come back to the shop from your store. Frequent payment failures can have a permanent negative impact on your brand image.

What are the most common reasons for transaction failures?

If most customers aren’t receiving the “Payment Successful” message, it’s time to assess what’s wrong.

Let us segregate the transaction failure into three categories:

Error from customers’ end

Often, the customer is responsible for hindering successful payment, knowingly or unknowingly. This is how:

- The customer enters the wrong card details (like CVV code, card number, expiration date, OTP) or bank details (account number, IFSC code)

- The customer doesn’t receive the OTP to verify a payment due to network or connection errors

- They don’t have sufficient balance in their account to complete a transaction

- The customer initiates a transaction but goes back to edit details like address or quantity of items, leading to payment failure

- Due to previously set transaction limits, a customer cannot make a payment successfully despite having sufficient funds in their account. This issue is more common in international transactions

- The customer’s credit/debit card is expired, and they have no idea and are using the same card to make a purchase

- According to the latest RBI mandate, all new cards have default settings “as disabled”. Hence, consumers have to log in to their issuer app and then make the changes to allow the card to be used for transactions. This is valid for online, POS, and ATM cash withdrawals. Hence, if consumers are unaware of this mandate and use the card without enabling the required fields, there will be a payment failure.

Payment ecosystem error

If it is not the customer, your payment ecosystem, like a bank, payment gateway, or payment processor, is probably causing the transaction failure. Here’s how:

- The acquirer or issuer bank is under maintenance routine and hence offline. Therefore, the server cannot reach either of the banks, resulting in unsuccessful payment. This also happens for payment gateways and payment processors

- Transaction failures are common when a payment gateway accepts only a limited number of payment methods. For example, the customer selects UPI as their preferred payment method, but the payment gateway doesn’t take it, leading to cart abandonment

Error to prevent a fraud transaction attempts

Banks have some basic fraud detection rules that automatically block any transaction attempt that deviates from those rules. For example, if a customer attempts to make an international transaction for the first time or purchases an expensive item, the bank may consider it fraudulent and block it immediately.

While the bank’s goal here is to prevent an unauthorised transaction, it may increase drop-offs.

Best practices to reduce the number of failed transactions on an eCommerce website

Getting a successful payment notification is not always in an online store merchant’s control. It is a long process involving multiple factors like banks, payment gateways, payment methods, and payment processors. In this complex electronic payment system, the entire system can collapse even if a minor element fails, leading to transaction failure.

It is not within your control to ensure a successful payment transaction every time. However, certain effective strategies exist to reduce failed transactions and increase the number of “Payment done successfully” messages.

These best practices focus on reducing inconveniences from the customers’ end so there are fewer last-minute drop-offs.

Improve your checkout experience with a seamless checkout page design

A checkout page defines the last mile in a customer’s journey. Any inconvenience at this stage can confuse customers, leading to a payment failure.

A checkout page should include the following elements:

- A brand logo to establish your brand identity and presence

- Customers return to their cart page from the checkout page if they have confusion or last-minute doubts about the products, quantities, and sizes. And as they leave the checkout page, the transaction becomes unsuccessful. Hence, it is best to keep an Order Summary section for a quick overview of the orders

- Most customers have multiple shipping addresses, and unless they tick on the correct box beside their desired shipping address, online stores capture the default shipping address. This, again, confuses customers, and they tend to leave the checkout page to ensure they have inserted the correct shipping details. Therefore, it is best to add shipping details to your checkout page so customers are free from doubts and can proceed to checkout seamlessly

- Your checkout page should also have multiple payment methods like UPI, Credit Card, Debit Card, Netbanking, Mobile Wallets etc. That way, customers won’t drop off from the checkout page simply because they didn’t find their preferred payment method

By adding all these elements and customising your checkout page, you can improve the customer’s checkout experience and avoid last-minute abandoned carts that affect the payment success rate.

Create an optimised checkout page that showcases eligible payment options

Your checkout page workflow looks something like this:

Customer inserts their contact number ➡️ and are immediately redirected to a checkout page where all their personalised payment information is already available

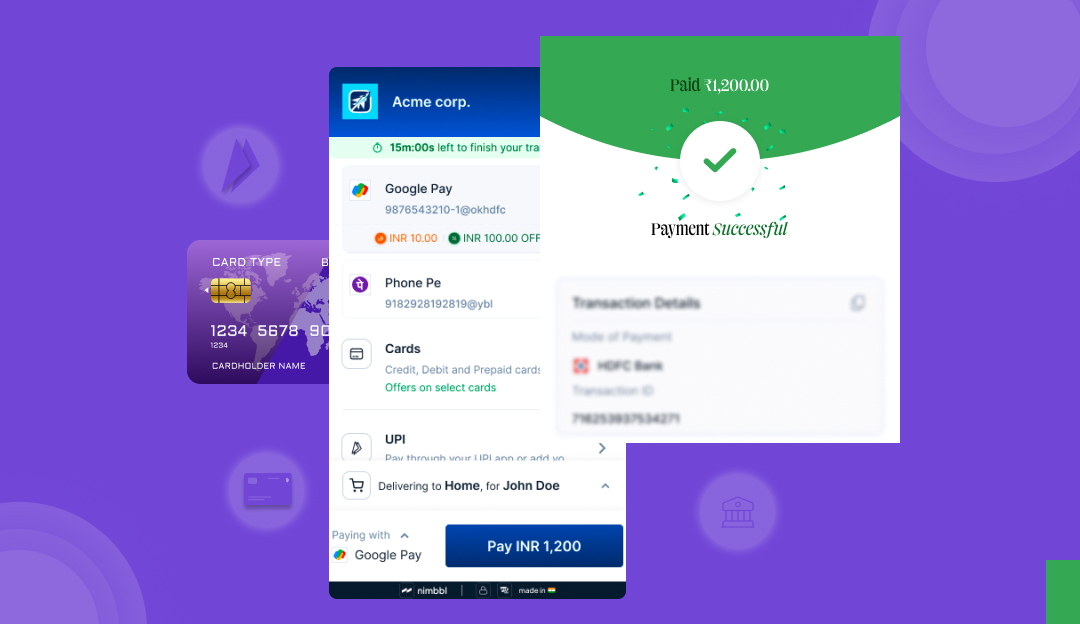

It would look something like this 👇

This means creating an optimised payment experience where the customer has all the payment options they are eligible for on a single page. They don’t need to remember UPI IDs, switch between applications to get a code or worry about not receiving an OTP.

These major reasons reduce payment success rates and a checkout page with personalised payment options. It reduces these frictions to create a fast checkout experience where completing a transaction and placing an order takes only a single click.

Opt for intelligent payment routing to increase payment success rate

A payment router integrates multiple payment gateways to your eCommerce store with just one integration. It identifies and routes customers to a personalised payment route that they are eligible for and speeds up a checkout process by eliminating the need to select a preferred payment method, leading to an increase in payment success rate.

Another advantage of integrating with an intelligent payment router is avoiding technical issues. Any technical matters related to the payment ecosystem often lead to payment failure.

An intelligent payment router is like a knowledgeable airport guide. It directs customers to the best payment gateway based on their preferences and eligibility, considering factors like technical issues and customer status. If a problem arises, it quickly provides alternatives, ensuring a smooth and successful payment journey.

How to handle failed payments for your eCommerce store?

While failed payments are not always in your control, the consequences can be destructive. To begin with, a reduced rate of successful payment leads to:

- Declining revenue

- Increased cost of operations

- Short-term or long-term reputational damage

In short, if you don’t handle your failed payments well, your online store can proceed toward a permanent closure.

Hence, it is better to stay prepared and take the above actions whenever there is an event of unsuccessful payment:

Keep the customers notified with a payment unsuccessful message

Just like you notify customers with a successful payment message, don’t forget to communicate an unsuccessful payment.

Note how Spotify communicates about unsuccessful transactions with their customers 👇

The messaging should be simple: You should communicate that the customer’s attempt at making a payment has failed and encourage them to retry the transaction.

If the payment is due to a technical issue, online stores often explain what went wrong and request that customers retry the transaction after one or two days.

While payment failures may cause losing out on customers, a timed notification can solidify their trust and motivate them to return to your store.

Bridge the gap between the customer and the payment gateway to retry the payment again

If your payment gateway permits, you can automatically set up a retrying of the payment. But if that option is unavailable or the second attempt fails again, you must contact the customers using a different approach to restart the checkout process. This is more critical when the payment fails due to issues from the customer’s end.

Suppose the transaction fails due to an insufficient balance in the customer’s bank account. You can send a message or email stating the exact issue and the solution, which is to add more balance to their account.

Unless you clarify, the customer will think the issue is from your end, and you may lose a customer pointlessly.

Conduct periodic checks on your payment ecosystem and take preventive measures

Reviewing your payment system regularly is a good idea. A closer assessment will quickly identify problem areas, possibilities of fraud intervention, whether your payment gateway plugins are working properly, etc.

These assessments will help you take preventive measures like:

- Verifying each payment details submitted by the new users before activating their accounts

- Set automated fraud detection triggers and actions to identify and block unauthorised users

- Use an intelligent payment router and support multiple payment gateways so that even if one payment method fails, the customers can be routed to another

- Provide customers with clear payment instructions so they know precisely how to complete their transactions seamlessly, and there is no room for confusion

Which payment gateway is most successful for ensuring successful transactions?

The payment gateway you select should be reliable and have a track record of processing multiple successful payments.

And our suggestion is – Nimbbl.

Here’s how Nimbbl can increase your payment success rate:

One-click checkout—Nimbbl’s one-click checkout solution ensures that the checkout process is completed within five seconds without any login passwords or OTPs. With a record of a 70% reduction in transaction completion time and adding personalised payment options for each customer to customise the checkout page, Nimbbl ensures more payment success notifications in your customers’ inboxes.

Intelligent payment router—With just one integration, Nimbbl connects your online store with multiple payment aggregators, such as UPI, Credit and Debit Cards, BNPL, Netbanking, etc. Nimbbl’s built-in intelligent payment router ensures a maximum payment success by routing customers to their personalised payment methods and faster transaction completion.

Plugins – Nimbbl integrates with any eCommerce platform available in India, be it:

- Wix

- Shopify

- WooCommerce

- WordPress

- OpenCart

The setup process is simple; you don’t need to write a single line of code to integrate Nimbbl with your online store.

Want to explore Nimbbl to improve your payment success rate?