Every month, your business processes thousands of payments. Every month, around 14% of those payments get declined by banks, not because customers don’t have money, but because the payment took the wrong route. That’s ₹14 lakhs vanishing from every ₹1 crore you process.

While you optimize ads and perfect products, invisible money bleeding occurs at checkout. Most businesses accept this as “normal payment behavior, ” but smart payment routing doesn’t.

The technology automatically finds the best path for each transaction, turning those failures into revenue. The math is stark, but the solution is surprisingly elegant.

This article explains how intelligent payment routing works and quantifies the revenue losses Indian businesses face from payment failures, providing a clear implementation roadmap to recover lost transactions.

Content Index

- The Problem: Money Lost in Failed Payments

- What Is Smart Payment Routing?

- How does Smart Routing Help Businesses?

- How to Get Started with Payment Routing?

- FAQs

The Problem: Money Lost in Failed Payments

India’s digital payment ecosystem faces a harsh reality: 14% of e-commerce transactions get declined by card issuers globally, while 50% of Indian consumers cite payment failure as a top concern with digital payments.

The numbers get more troubling when you look at specific payment methods. Indian payment gateways have lower success rates than their Western counterparts due to bank server issues and network connectivity problems. Despite its popularity, UPI struggles with reliability challenges that impact merchant revenues.

Real cost: For a business processing ₹1 crore monthly, a 14% failure rate translates to ₹14 lakhs in lost transactions every month. That’s ₹1.68 crores annually—money that never reaches your account despite customers being ready to pay.

The customer impact compounds the problem. 59% of shoppers abandon their purchase if their preferred payment method isn’t available, creating a cascade of lost revenue that extends far beyond the initial failed transaction.

What Is Smart Payment Routing?

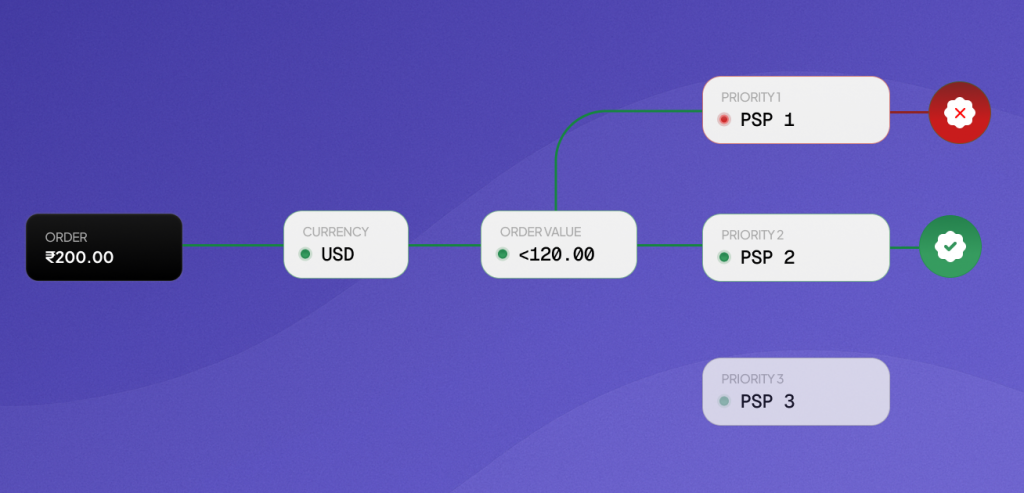

Based on real-time analysis, smart payment routing automatically selects the optimal payment service provider (PSP) for each transaction. Instead of processing all payments through a single gateway, the system evaluates multiple factors—card type, issuer bank, transaction amount, customer location, and current PSP performance—then routes to the provider with the highest approval probability.

The process works through cascading logic. When a customer initiates payment, the router first attempts the primary PSP. If that fails due to technical issues, high traffic, or bank-specific problems, it instantly redirects to a secondary provider without customer intervention. This happens within milliseconds, appearing as a single attempt to the user.

For example, if net banking through PSP A is experiencing downtime, the router automatically redirects the transaction to net banking through PSP B. If UPI payments typically fail for a specific bank during peak hours, those transactions get routed to alternative providers with better success rates for that timeframe.

The technology requires just one integration to access multiple PSPs, eliminating the need for separate connections with each payment provider. This unified approach reduces technical complexity while maximizing transaction success rates across your entire payment infrastructure.

How does Smart Routing Help Businesses?

Payment failures create a predictable cascade: customers attempt checkout, encounter errors, retry once or twice, then abandon their purchase entirely. For subscription businesses, the problem compounds when loyal customers churn simply because their automatic renewals fail repeatedly. These systematic revenue leaks occur across industries, from e-commerce to SaaS to digital services.

Higher success rates

Intelligent routing improves payment approval rates by automatically directing transactions through the most reliable channels. For businesses processing substantial volumes, this translates to meaningful revenue recovery—transactions that would have failed now complete successfully.

Streamlined customer experience

Smart routing eliminates the friction that causes cart abandonment. Customers no longer need to retry failed payments or switch between apps manually—the system handles failures invisibly in the background, automatically rerouting to working payment channels within seconds.

Cost optimization: The routing logic automatically selects each transaction type’s most cost-effective payment provider. Domestic UPI payments get routed to low-cost providers, while international card transactions go through specialized gateways with better approval rates, even if fees are slightly higher. A successful higher-fee transaction beats a failed low-fee attempt.

Reduced customer service load

Customer service teams report dramatic reductions in payment-related complaints after implementing intelligent routing. The technology eliminates most support calls by preventing failures before they happen. Fewer frustrated customers means lower support costs and higher customer satisfaction scores.

Businesses lose up to 3.6% of annual revenue due to payment failures, but companies with smart routing systems report the opposite—they recover revenue they didn’t even know they were losing. The technology transforms payment processing from a necessary cost center into a revenue optimization tool that directly impacts the bottom line.

How to Get Started with Payment Routing?

Smart payment routing might sound complex, but implementation is straightforward. The key is approaching it methodically—measure your current losses, quantify the opportunity, then implement and scale based on results.

Measure your current payment failure rate

Start by auditing your existing payment data. Calculate the percentage of transactions that fail across different payment methods—cards, UPI, net banking, and wallets. Most businesses discover failure rates higher than expected, often ranging from 8% to 15%, depending on their setup and customer base.

Calculate potential revenue recovery

Apply your failure rate to your monthly transaction volume to quantify lost revenue. If you process ₹50 lakhs monthly with a 12% failure rate, that’s ₹6 lakhs in potential recovery each month. Multiply by 12 months to see the annual impact—₹72 lakhs in this example.

Choose a technology provider with smart routing capabilities

Evaluate providers based on their routing sophistication, not just pricing. Look for features like real-time performance monitoring, multiple PSP integrations, automatic failover logic, and detailed analytics. We recommend Nimbbl. Here’s how it works:

Nimbbl provides a unified dashboard that connects 12+ payment aggregators, including PayU, Worldline, CCavenue, and BillDesk, through a single integration. This approach allows businesses to add or remove PSPs, switch between them, and change routing priorities without complex technical implementations.

Start small, scale based on results

Begin implementation with your highest-value transactions or most problematic payment methods. Monitor success rates, customer experience metrics, and cost per transaction for 30-60 days. For NBFCs and subscription businesses, start with peak repayment periods when transaction volumes are highest and failures are most costly. Once you validate the improvement, gradually expand routing to cover your entire payment ecosystem.

The key is treating this as a data-driven optimization project rather than a simple vendor switch—track metrics before and after implementation to measure actual revenue recovery and ROI from your smart routing investment.

Want to explore more?

FAQs

What is smart payment routing?

Smart payment routing automatically directs each transaction to the optimal payment provider based on real-time analysis, maximizing approval rates and minimizing costs.

How does smart routing work?

The system evaluates factors like card type, bank performance, and transaction amount, then routes payments through the provider most likely to succeed.

What is the smart routing protocol?

The cascading logic attempts primary payment providers first, then instantly redirects to backup options if the initial attempt fails.