Online payments have so many upsides. But, if you’re like most online merchants, you too may have experienced online payment problems in the past. Online payment problems can sometimes be frustrating, especially when your customers are trying to complete an online transaction and the payment keeps failing. Starting an online business is exciting. Ensuring that your online business provides valuable and appealing products or services and then collecting payments easily can be challenging sometimes.

According to a Statista report in 2022, the amount of money people pay online will reach $8.56 trillion annually; this doesn’t even account for the brick-and-mortar stores that are starting to adopt online payments as well.

What’s the best way to handle online payment problems today? How to avoid the common payment problem? How can you protect yourself from online payment fraud? It’s important to know how to solve these problems to keep your customers happy.

You may have never considered these questions, but millions of online shoppers deal with similar issues every day, and it’s essential to know how to deal with them quickly and effectively. Here are the five common online payment problems and how to solve them.

Content Index

Common online payment problems with solutions

Problem #1: High checkout abandonments

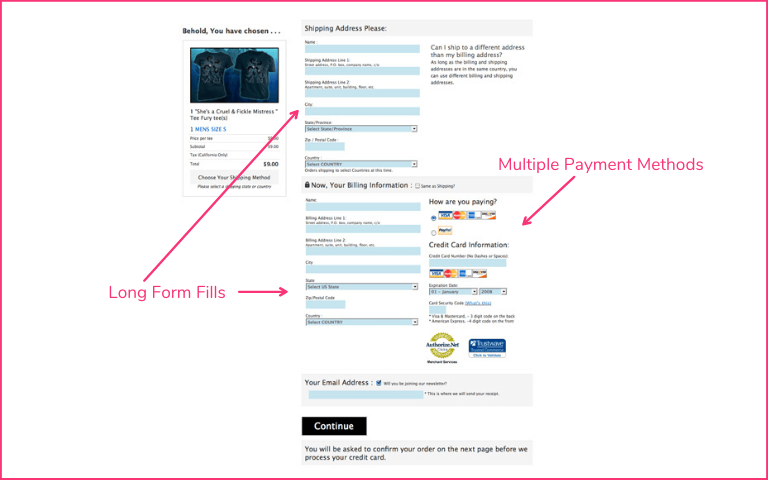

Shopping cart abandonment is one of the biggest issues in the eCommerce industry. According to Forrester research, eCommerce brands lose a staggering $18 billion in yearly sales revenue. Poor payment experience, long forms, non-availability of customer’s preferred payment method, forced account creation, and additional costs shown at the later stage of checkout are some of the common reasons for abandonment.

Solutions

- One-click checkout experience where customers can buy instantly.

- No redirections, OTPs, passwords and other forms of friction.

- Offer a personalised checkout where customers only see payment methods relevant to them.

- Password-less login where customers don’t need to enter OTP or passwords to access their favourite payment methods.

- Showcase important order and shipping information through the checkout process

Problem #2: Payment method preferences of customers

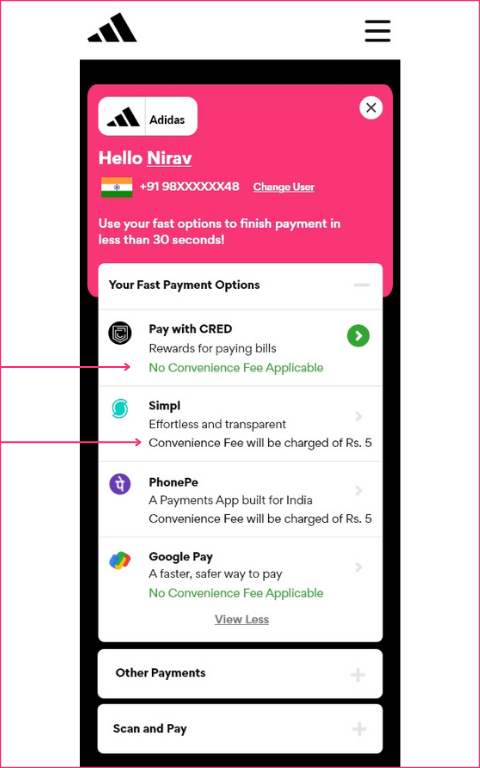

Customer preference for paying online is ever-evolving. Every customer may have a different choice of payment method preference. Credit cards, debit cards, Buy Now Pay Later (BNPL), UPI, wallets, net banking, and cash are some of the payment methods that customers prefer. BNPL and UPI are growing fast and becoming customers’ favourite modes of payment. But how do you cope with this change and offer relevant, personalised payment methods to customers?

Solutions

- To avoid such problems, it’s always good to have multiple options for accepting online payments.

- You can choose a payment processor that accepts all types of payments.

- Choose a checkout solution like Nimbbl, where you get access to the latest payment methods in a single API.

- The flow is built in a way where customers can complete the payment with their favourite payment methods without additional clicks or inputs.

- This way, you can increase your sales and don’t have to worry about losing customers due to problems with online payments.

- Below is the Nimbbl’s Magik UPI flow, where customers’ UPI options are presented automatically without any additional clicks. This flow is 11x faster than the regular flow with 45%+ higher conversions.

Problem #3: Getting paid late (payouts)

Paying your vendors, and sellers and managing cashflows can be a big challenge if the payment settlements don’t happen in a timely manner.

Solutions

- Business and bank accounts need to be linked for easy fund transfer. Make sure this is done properly while setting up an account with a payment partner.

- Set up automatic deposits for larger accounts, so you don’t have to worry about manually transferring money each month.

- If you find yourself with an online payment issue (or any other problem), contact your merchant services provider immediately for help and advice.

- If you’re experiencing online payment issues with your gateway of choice, it’s best to look for an alternative that offers faster processing times and more reliable payouts.

- Look for providers with multiple payment gateways. In case you face any issue with one provider, it should be easy for you to switch over to the other provider without developer or onboarding efforts.

Problem #4: Security issues

One of the most common online payment issues is security lapses. There are multiple reasons why a customer may have trouble with online payments. The first is that they don’t trust it – they are worried about identity theft or being tracked. It could also be that they aren’t sure how secure their information is, especially if you aren’t correctly encrypting it or protecting their data from intrusion.

Solutions

- Encrypt your customer’s data: If you store customer data online, you need to make sure it is encrypted and protected. If hackers get into your system, they can use that information for identity theft or other malicious purposes. You want to protect your customers from that by keeping their data safe. It would help if you also kept an eye on any new laws about online security and any updates to current laws in your area.

- Make sure you have a secure website: The most common online payment problems are related to hacking and phishing scams.

Problem #5: Disputed processes and transactions

One of the most common problems with online payments is when a customer disputes a transaction you’ve charged on their account. This happens when your customer either claims they never made a purchase or they don’t recognise it as such.

This can happen for many reasons but usually occurs for reasons such as you didn’t provide them with an invoice at the time of purchase; they forgot about making a purchase; they were overcharged by mistake, or the product was defective, and they want to return it.

Solutions

- Send your customers an invoice every time they make a purchase. This way, you’ll be able to prove that they authorised each transaction.

- Make sure you’re charging only for products or services you provide, which will help prevent overcharging by mistake.

- If a customer claims they never made a purchase, ask them if they remember making it; if not, their account has likely been hacked, and someone else is trying to use their payment method information without their knowledge.

- Remember, if a customer is unsatisfied with their purchase, they can always get a refund or exchange for another product. Make sure you have a clear policy on returns and exchanges in place before you begin selling anything online.

- Contact your merchant account provider and ask them how you can prevent fraudulent purchases or disputing customers.

Problem #6: Maxed-out credit cards

Customers attempting transactions with maxed-out credit cards create significant disruptions for eCommerce stores. Using the entire credit limit not only impacts credit scores but also leads to multiple failed payment attempts, causing inventory holds and revenue delays.

For eCommerce businesses, this results in abandoned carts, increased customer service inquiries, and potential loss of sales. The situation becomes particularly challenging during sale periods or festive seasons when transaction volumes are high, and customers are more likely to reach their credit limits.

Solutions:

- Implement real-time credit limit verification before processing transactions to reduce failed attempts

- Offer alternative payment methods like UPI, net banking, or EMI options when card limits are reached

- Send clear error messages explaining the reason for transaction failure

- Provide instant notifications about payment status to avoid multiple failed attempts

- Enable customers to save multiple payment methods in their accounts for backup options

- Display available EMI options prominently during checkout to prevent card maxing

Problem #7: Account suspensions for closures

Indian eCommerce businesses frequently face unexpected payment account suspensions, creating severe operational disruptions. These suspensions can occur without warning and may freeze existing funds, halt new transactions, and damage customer relationships.

For growing eCommerce stores, such suspensions can lead to significant revenue losses, inventory management issues, and potential damage to brand reputation. Small and medium-sized businesses are particularly vulnerable as they may lack the resources to quickly implement alternative payment solutions.

Solutions:

- Maintain detailed transaction records and documentation for quick verification if required

- Set up backup payment processing options through multiple providers to ensure business continuity

- Keep business information and KYC documents updated regularly

- Monitor transaction patterns to identify potential triggers for suspensions

- Implement robust fraud prevention measures to avoid triggering automated security systems

- Establish direct communication channels with payment service providers for quick resolution

- Consider working with specialised payment processors familiar with high-risk industries

- Create emergency response plans for account suspensions

- Maintain reserve funds to manage operational costs during suspension periods

- Build relationships with multiple banking partners for alternative processing options

Problem #8: Delays in processing refunds

Refund delays are a significant concern for Indian eCommerce stores, affecting customer satisfaction, trust, and repeat purchase rates. These delays occur due to multiple parties involved in the refund process, including payment gateways, acquiring banks, and issuing banks.

For eCommerce businesses, delayed refunds can result in increased customer complaints, negative reviews, social media backlash, and potential regulatory scrutiny. This is particularly challenging for fashion and lifestyle retailers who experience higher return rates.

Solutions:

- Implement automated refund tracking systems that integrate with customer communication channels

- Clearly communicate expected refund timelines based on payment methods. For example, typically the time taken is as follows: Credit/Debit Cards: 5-10 business days, Net Banking: 2-10 business days, Digital Wallets: Instant to 3 days, and UPI: 2-7 business days

- Provide regular status updates through automated notifications

- Maintain transparent communication about refund processing stages

- Set up dedicated teams for handling refund-related queries

- Use payment gateways that offer instant refund capabilities

- Create detailed documentation of refund processes for customer support teams

- Implement proactive refund status communication to reduce support tickets

- Consider offering store credits or instant vouchers as alternatives to refunds

- Maintain adequate working capital to process refunds promptly

- Build automated reconciliation systems to track refund statuses across different payment methods

Final thoughts

Paying for goods and services online is easier and more secure than ever. Yet problems with online payments do occur, and they’re a real pain when they do. This article will help you recognise common online payment problems and offer some solutions that can help you solve these issues before they impact your business.

If you run into one of these online payment problems today, check out our tips above and try using them to resolve your issue.

FAQs

When your customers pay online, their sensitive data is at risk of being intercepted. Every time they use a debit/credit card or enter your bank account number online, they expose themselves to potential danger. Hackers may steal their information and use it for fraud and identity theft. Protect yourself by using secure Internet payment systems instead of non-secure ones.

India is experiencing a surge in online transactions. Online payment in India is safe and secure. However, some common problems are associated with it, which you should be aware of before making online payments.

There are several reasons why online payments fail for customers: using an expired credit card or entering an invalid CVV; using an unsupported payment method, or their bank rejecting or declining the payment.

The internet has gained popularity, and access to it is now almost universal. This means that more and more people are conducting their business online. This also means that more and more people are making payments online. Growth in online transactions has led to an increase in online payment options.