UPI payments are fast for app-based flows. But we had a few questions for browser flows. What can be done to improve the experience? How to reduce the time taken to complete the purchase. How to improve the success rates? How to personalise the discovery of the UPI apps at the checkout? How to bring in all these without additional clicks and effort for the customers.

India is undeniably going through a massive digital payments revolution. A crucial contributor to this digital boom is real-time payment platforms. The advent of the Unified Payments Interface (UPI) was the first among the many efforts focused on making India a cashless economy. Launched in 2016, UPI offers convenience and ease of payment through the click of a button. For FY ‘22, UPI transactions crossed the $1-Trillion mark.

There was a need for a magical solution to further improve the UPI experience across any device or browser. Enter Magik UPI. A solution to improve customer experience with faster payments and higher conversions for businesses. Read this article to get all the details.

Content Index:

- UPI ID as the friction creator

- Reasons for the failure in UPI ID-based payments

- Magik UPI for frictionless UPI transactions

- Benefits and impact of Magik UPI for businesses

- Get the Magik for your business

UPI ID: the friction creator

The payment experience holds immense importance for today’s customers. Every step that comes in the way of a seamless payment process can hold back the customer from completing the purchase.

UPI ID-based payments, where customers have to enter their UPI ID at the checkout page, are full of friction. Remembering, searching for the UPI ID; entering incorrect UPI ID, taking time to complete the UPI payment while switching apps, closing the payment page by mistake, and time-outs are some of the many issues related to the UPI ID flow.

All of these lead to a sub-par experience for the customer along with payment failures. These UPI ID-related issues contribute ~ 33% of payment drops (Nimbbl data). We realized the need for a faster UPI ID-based payments experience and dug deeper to find the root cause of the problem.

Reasons for the failure in UPI ID-based payments

1. Customers don’t know what a UPI ID is

Yes, your customers might not even know they have a UPI ID! In the best possible scenario, they might know that they have a UPI ID but don’t know where to exactly find it. This cumbersome process can lead to frustrated customers abandoning the checkout process.

2. The curious case of finding UPI ID

With over a dozen apps providing UPI features, a customer is likely to have multiple UPI IDs. When asked about the UPI ID during the payment flow, they get confused. And try to find their UPI ID among multiple apps and screens. All this can lead to higher chances of payment failure.

3. Entering the wrong UPI ID

Let’s face the reality, your customers don’t keep a record of the UPI IDs they have. Neither do they remember the IDs nor do they want to invest the time in maintaining a register of their UPI IDs. All this can increase the chances of a customer entering the wrong UPI ID. This again hampers the chances of a successful payment.

4. Fear of payment failures

Customers fear that moving away from the checkout page may lead to payment drops. They may close the checkout browser by mistake and ultimately will lose all their cart items.

Enter Magik UPI for frictionless UPI transactions

As a solution to the UPI ID-based payment flow problems, we introduce Magik UPI. With this feature, customers will no longer have to remember or search for their UPI IDs or UPI apps during transactions. They pay via their favourite UPI app in no time.

Benefits and impact of Magik UPI for businesses

1. Personalised payment experience

- Every customer is presented with personalised UPI options, they are eligible for.

- They don’t need to remember their UPI IDs or open multiple UPI apps.

- No additional inputs are required by the customer.

- The feature enables the discovery of UPI IDs for all the top UPI apps.

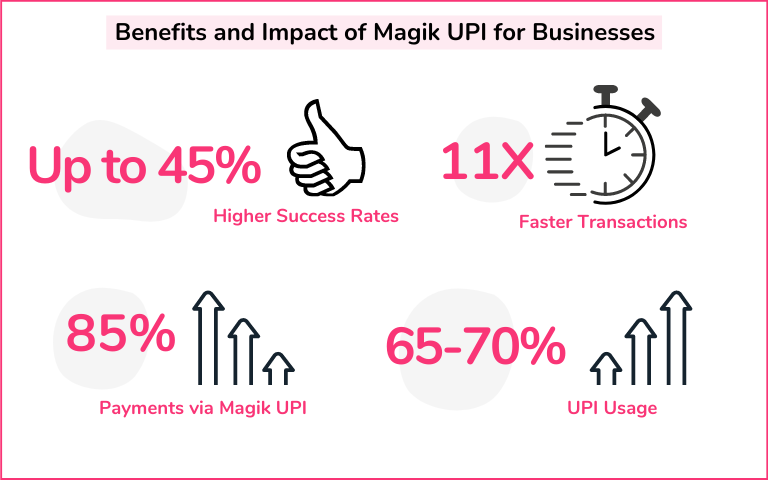

2. Faster transactions

- With the Nimbbl Magik UPI flow, we have drastically reduced the UPI transaction time.

- The time to initiate a Magik UPI transaction is 11X faster than cards, net banking, and standard UPI collect flows.

- The reduction in time helps to complete transactions faster, improving the customer experience and reducing checkout abandonment by avoiding last moment mind changes.

3. Up to 45% higher success rates

- With the Magik UPI flow, 85% of customers are now able to complete their transactions without having to manually enter their UPI ID.

- Customer drop-offs because they didn’t know what their UPI ID is/confused about switching apps and browsers are now taken care of with the Magik UPI flow.

- The overall success rate improved by 35% to 45% over standard flows.

4. Reduce payment processing costs

- UPI is the fastest growing payment method in the country. With the Nimbbl Magik UPI flow, the contextual discovery of the UPI apps improves significantly.

- UPI’s share of transactions grew steadily post the launch of Magik UPI taking away a share from card payments.

- Average UPI payment method preference in the standard flows – 45% of the volume.

- With Magik UPI, the UPI usage is between 65% to 70%.

- Half of the card-based payment share has been shifted to UPI, resulting in cheaper payment processing fees for merchants for whom Magik UPI is implemented.

Get the Magik for your business

We at Nimbbl have always been invested in the growth of the latest payment modes to provide the best checkout experience for customers and merchants, so businesses can focus on what they do best. Offer the best UPI experience for customers pre-built with Nimbbl checkout or via APIs. You can connect with our team to get the Magik UPI for your business.