Picture this: It’s the final day of your big festival sale, orders are flooding in, and suddenly your payment system crashes. Customers can’t check out, and you watch helplessly as lakhs of potential sales evaporate.

This nightmare scenario plays out more often than you’d think. For Ashish, an e-commerce founder, a six-hour payment gateway outage during Diwali cost his business ₹15 lakhs in lost sales. With digital payments in India projected to reach ₹450 trillion by 2025, companies can no longer afford such disruptions.

This article explores why integrating multiple payment gateways is not just a technical decision, but a strategic business move that protects your revenue, improves the customer experience, and supports your growth trajectory.

Content Index

- What is a Payment Gateway?

- How Multiple Gateways Drive Business Growth?

- Common Challenges When Implementing Multiple Payment Gateways

- How Nimbbl Solves Multi-Gateway Challenges for Growing Businesses

- The Bottom Line

What is a Payment Gateway?

A payment gateway is the digital version of a physical point-of-sale terminal. It’s the technology that securely processes customer payments on your website or app, verifying card details, checking for sufficient funds, and ultimately transferring money from your customer’s account to your business account.

Think of it like having just one entrance to a busy shopping mall. When hundreds of people try to enter at the same time, bottlenecks form. Now imagine that the entrance suddenly closes for maintenance—nobody gets in, and business stops completely.

This is what happens when you rely on a single payment gateway. Single gateway setups face several critical challenges.

Why do single payment gateway setups fail in growing businesses?

Relying on just one payment gateway is like putting all your business eggs in a single basket. As your business scales, this approach creates serious vulnerabilities that can directly impact your bottom line.

Payment gateways aren’t created equal. Each has unique strengths and weaknesses in processing different types of payments. While one excels at card payments, another might handle UPI transactions more efficiently. When you’re limited to a single gateway, you’re forced to accept its performance gaps across various payment methods.

Downtime is inevitable in digital infrastructure. Even top-tier payment providers experience occasional outages. These service interruptions can result in significant revenue losses, especially during high-volume sales periods or promotional events. For growing businesses, these unexpected revenue gaps can disrupt monthly targets and strain cash flow.

Customer payment preferences vary widely across India. Urban customers often prefer credit cards, while those in tier-2 cities tend to choose UPI or wallets. A single gateway can’t optimize for these regional differences, forcing some customers to use payment methods they don’t trust or regularly use.

Success rates fluctuate dramatically between gateways. Different providers achieve varying success rates with other banks and payment methods. These percentage differences translate directly to lost sales when you’re locked into one system.

Transaction costs vary significantly. Payment gateway fees can differ substantially depending on payment type and volume. Without the ability to route transactions strategically, you’re paying premium prices on every transaction.

Tech integration grows more complex as you scale. Adding new payment methods or expanding to new markets requires technical workarounds when you’re constrained by a single gateway’s capabilities and roadmap.

High-growth businesses need payment infrastructure that scales with them, not one that becomes a bottleneck during crucial growth phases.

How Multiple Gateways Drive Business Growth?

A multi-payment gateway setup connects your business to multiple payment processors through a single unified integration. This approach offers several distinct advantages:

Wide Payment Method Coverage: Support a variety of payment options, from traditional card payments to mobile wallets and UPI, making it easy for customers to pay using their preferred method.

Improved Reliability: Minimize transaction failures due to gateway downtime. When one gateway encounters issues, others continue processing payments without disruption.

Global Reach: Process payments in multiple currencies, enabling your business to cater to customers across different regions effortlessly.

Increased Conversion Rates: Reduce cart abandonment by offering payment flexibility. When customers can pay their way, they’re more likely to complete their purchase.

Simplified Payment Management: Consolidate all payment operations on one platform, saving time and resources that would otherwise be spent managing multiple separate integrations.

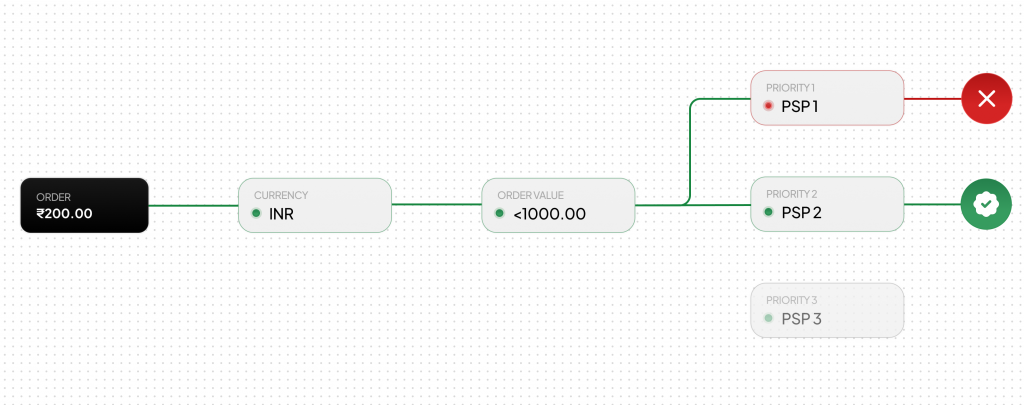

Better Transaction Success Rates: Route payments through gateways with the highest success rates for specific payment methods or banks, maximizing the number of completed transactions.

Load Distribution: Handle traffic spikes during sales or peak seasons by distributing transactions across multiple gateways, preventing overload on a single processor.

Optimized Processing Costs: Route transactions strategically to take advantage of better rates for specific payment types, reducing your overall payment processing expenses.

Common Challenges When Implementing Multiple Payment Gateways

Each additional gateway requires separate technical integration, which could demand more development resources and time. Without proper planning, this can strain your tech team and extend implementation timelines.

Reconciliation and reporting complications

Tracking transactions across several gateways can complicate accounting processes. Your finance team may spend extra hours matching transactions and resolving discrepancies if you don’t have a system that consolidates reporting.

Security and compliance considerations

Each gateway integration creates additional points requiring security oversight and compliance maintenance. Managing PCI-DSS requirements and data protection measures across multiple providers requires careful attention to avoid vulnerabilities.

How Nimbbl Solves Multi-Gateway Challenges for Growing Businesses

Implementing multiple payment gateways doesn’t have to be complicated. Nimbbl’s Multi-Payment Gateway Solution addresses the common challenges businesses face while maximizing the benefits of a diverse payment setup.

A single integration for multiple gateways

Nimbbl eliminates integration headaches by providing access to 15+ leading payment gateways through a single API integration. This means your tech team can implement one solution instead of managing separate integrations with each provider, saving valuable development time and resources.

Comprehensive payment method coverage

Our solution supports all primary payment methods Indian customers prefer—cards, UPI, wallets, net banking, and more—through trusted gateways including Razorpay, Cashfree, PayU, CCAvenue, PhonePe, Paytm, and HDFC PG. This ensures your customers can always pay using their preferred method.

Unified dashboard and simplified management

Nimbbl consolidates all payment data into a single, intuitive dashboard, solving reconciliation challenges by providing a clear view of transactions across all gateways. This streamlines operations and reduces the administrative burden on your finance team.

Enhanced payment reliability

With automatic transaction routing across multiple gateways, Nimbbl ensures payment continuity even if one gateway experiences downtime. This redundancy ensures your business runs smoothly during peak sales periods, when reliable payment processing is most critical.

Global payment processing

For businesses expanding internationally, Nimbbl supports multiple currencies through gateways optimized for global transactions, including Checkout.com and PayGlocal. This makes serving international customers as seamless as domestic ones.

Advanced security across all gateways

Nimbbl maintains robust security protocols across all integrated payment gateways, ensuring PCI-DSS compliance and protecting sensitive customer data, regardless of which gateway processes the transaction.

The Bottom Line

As you grow your business in India’s booming digital market, your payment system shouldn’t hold you back. Multiple payment gateways aren’t just a nice-to-have—they’re essential protection against costly downtime and missed sales opportunities.

Nimbbl makes this transition simple with one integration connecting you to 15+ payment options. Don’t let payment bottlenecks limit your growth when the solution is just one conversation away.