Add a product to the cart ➡️ add address ➡️ make the payment ➡️ get order confirmation ➡️ leave.

That’s typically what customers expect when shopping from an eCommerce store.

But does that happen every time? Not really!

Customers have to endure the agony of a long checkout process, during which they are forced to select from a universal pool of payment methods with varying degrees of probability for them to work for them to complete a purchase.

Sometimes, checkout pages are longer with complex forms, guest checkout is unavailable, and only a handful of payment options exist. All these are customer repellers and major drivers of increasing cart abandonment rates. The average cart abandonment rate in Asia and the Pacific is already a whopping 76.32%. You don’t want to risk it, do you?

Fast checkout has become a game-changer for Indian eCommerce stores.

A fast checkout app simplifies the checkout process by reducing data entries for customers, reduces cart abandonment by improving access to offers & high success rate payment methods, and increases the possibility of repeat purchases.

This blog will discuss fast checkout, how it works, what challenges it solves, and some of the tried and tested best practices.

Content Index

- What is fast checkout?

- Why do you need a fast checkout solution?

- How does fast checkout work?

- Elements of a fast checkout page

- Best practices to optimise fast checkout experience

- Introducing the best fast checkout solution in India

What is fast checkout?

Fast checkout is a simpler and quicker process for completing a customer’s checkout so they can place an order quickly. Fast checkout is like having an express lane at the supermarket checkout. Instead of waiting in a long line and going through tedious scanning and payment steps, you can quickly place your items on the conveyor belt, pay, and be on your way in no time.

A fast checkout app removes all the unnecessary steps in the checkout process and designs an exceptional experience that engages customers and promotes fast conversion. With fast checkout providers, it takes only one click and a few seconds to complete the checkout, and that too with satisfied customers who are likely to revisit your store.

Why do you need a fast checkout application?

The challenges associated with the traditional checkout process are:

- It is slow. Customers get frustrated when the checkout takes longer than expected, there are irrelevant form fields that you don’t need to fill out, yet you have to (think: gender, birthplace, etc.), slow landing pages with loading issues

- Absence of guest checkout. Some eCommerce stores have this ground rule – if you want to buy from us, you must register as a user. Again, this frustrates customers as they don’t want to remember another password. All they want is to complete a purchase and leave

- Limited payment methods. Some online stores still have only one payment method on their checkout pages – credit cards. This is disappointing for Indian customers as 52% of Indian digital transactions happen via UPI, and the availability of UPI, BNPL, net banking, and similar other payment methods that the customers are eligible for increase their satisfaction rate

Fast checkout providers address these challenges, increasing conversion rates.

- From the name itself, it is clear that fast checkout solutions are FAST! But how fast? Well, by integrating with a fast checkout provider, a customer can go from checkout to order placement within seconds (forget minutes)

- 73% of online shoppers abandon shopping carts due to a long checkout. A fast checkout solution ends this by personalising the checkout experience and reducing human efforts (like filling in billing details every time). Faster checkouts account for reduced cart abandonment

- Fast checkout makes your customers feel valued. A quick checkout app integrates multiple payment methods to provide customers with options. When a customer inserts their contact number in the merchant’s website, the fast checkout app customises their payment options. Customers can view all the payment methods for which they are eligible. This improves their checkout experience and encourages them to purchase from the same store again. All these can be done with just an extra layer of OTP-driven security to ensure data protection

How does fast checkout work?

Here is how a fast checkout solution works:

Context: A customer has added a product to the cart and clicks “Buy Now” followed by “Proceed to checkout” to pay and place the order.

Step 1: The customer fills out the required billing details.

Step 2: The customer needs to select the fast checkout solution integrated into the store and click on “Checkout” again

Step 3: the customer sees the payment options customised for them on the checkout along with standard ones (ensuring no loss of choice for them, if needed)

Step 4: Select the fast payment option of their choice, Complete the payment and place the order

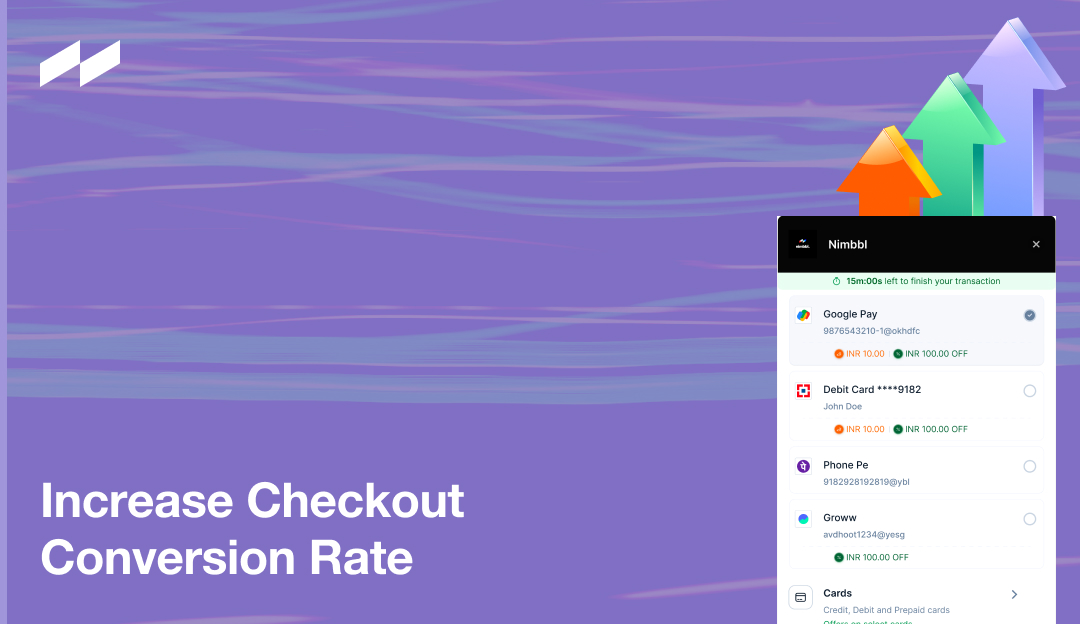

See below 👇

Elements of a Fast Checkout Page

An ideal fast checkout page must include the following elements 👇

Brand logo – The logo on your fast checkout page becomes a subtle branding element. Your brand logo and color consistently interact with the customer and your brand assets throughout the checkout process. This builds trust and creates a lasting impression in your customers’ minds.

Shipping details – Add shipping details to the checkout page as a fast checkout company. It helps customers have one final glance at the shipping details before making the payment.

📚Pro Tip: Add an editing option here so the customer doesn’t have to return to the cart to make minor changes to their shipping address.

Order summary – A brief order summary section on the checkout page lets the customer review the product details, quantity, size, price, shipping charges, and final payable amount. There should be no last-minute surprises or hidden costs that could push the customer to cancel the transaction. Keep your order and payment details transparent.

Fast payment options – Showcase the personalised payment methods the customer is eligible for. Feature the discounts, display their UPI so they don’t have to insert these details manually. They can directly click on their preferred payment method to complete the purchase.

Best practices to optimise fast checkout experience

eCommerce stores always put their best foot forward when designing a digital journey for their customers. From simple user interface to attractive promo codes, they don’t miss any chance to impress their customers.

Create an optimised checkout experience to complete the digital journey positively and win customers’ trust at the last mile of their eCommerce journey.

Here are some best practices:

Opt for a fast checkout solution

A fast checkout solution is ultra-fast, allowing users to place their orders with just a single click. It directs customers to a page with fewer form fields, personalised payment options, and smarter flows with authentication and eligibility checks via API.

These fast checkout applications are powered by alternative digital payment methods like UPI and BNPL, enabling transactions to be completed within seconds.

Use an intelligent payment router

An optimised, fast checkout page must have multiple payment gateways. That way, the customers are free to pick the payment gateway that works best for them. But that means multiple payment integrations that make the checkout process all the more complicated.

This is where an intelligent payment router comes into play. With just one integration on your website or mobile app, a payment router connects with different payment service providers to effectively route customers to their payment gateways.

An intelligent payment router finds the fastest payment route, reducing drop-offs.

Add trust signals to the checkout page

Trust signals on the checkout page reassure customers about data safety and prevent fraud.

Trust signals on the checkout page are like the security measures you see at a bank. Just as the presence of security cameras, guards, and vaults instills confidence in the bank’s ability to keep your money safe, trust signals like encryption certificates and payment processor logos assure customers that their personal and financial information is secure during checkout.

These trust signals can be simple elements like – customer testimonials, encryption type, payment processor’s logos, and HTTPS certificates.

Keep your checkout page mobile-friendly

81% of Indian customers use smartphones or mobile devices to complete a purchase. With most eCommerce customers using mobile devices for online transactions, keeping your fast checkout pages mobile-friendly makes sense.

Add simple CTAs

Fast checkout is the last mile of completing a transaction; you don’t want to confuse customers. At this point, your CTAs should be simple enough to direct customers through the checkout process.

Consider CTAs like “Pay INR 5” instead of “Pay Now.” While both CTAs release the same messaging, the first CTA encourages the customer to proceed and complete a transaction without second thoughts.

Introducing the best fast checkout solution in India

Are you looking for one of India’s best fast checkout apps?

Enter – Nimbbl.

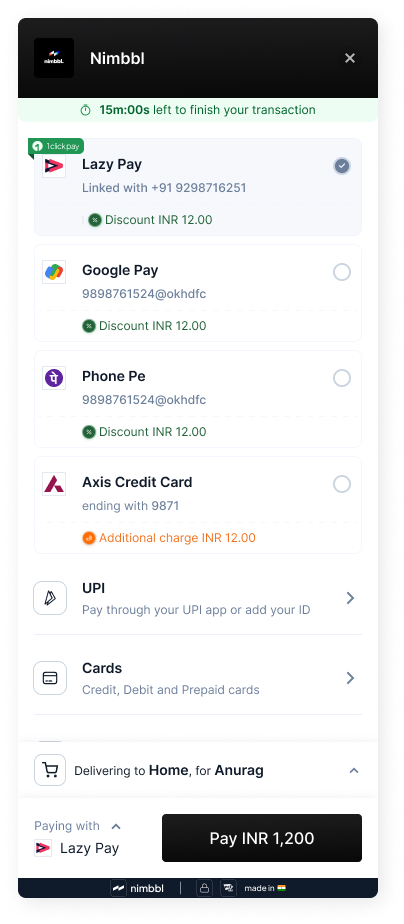

Nimbbl’s one-click, fast checkout ensures faster payment completion and order placement with fewer clicks.

The features of Nimbbl include:

- One-click personalised checkout experience for each customer

- Quick page loading, secured and optimised checkout for all device types

- Smarter checkout flow with API checks, reducing transaction time and steps

- Availability of new-age payment methods like BNPL and UPI without additional customer efforts

- Built-in intelligent payment router that integrates multiple payment aggregators with one integration

- Transparent payment information and no hidden charges

Want to dive deeper into the world of fast checkout?