Suppose you are a small business owner or new eCommerce merchant trying to strengthen your position in an already competitive marketplace. Streamlining your payment experience is probably at the top of your to-do list. This should be because 22% of customers leave their carts due to a complex checkout process.

While creating an optimised payment experience for customers, many eCommerce merchants often forget about the easiest yet underrated payment enabler: payment links.

Payment links, generated through a link generator, allow customers to pay instantly through their preferred payment modes (UPI, Credit Card, Debit Card, Wallet and whatnot!). You can offer custom offers and discounts to persuade customers who abandoned their carts using payment links.

While most eCommerce stores already know about payment links, there is a serious knowledge gap regarding how to generate them and, more importantly, how to effectively use them to win customers’ trust. That’s exactly what we will show you in this article.

Content Index

- What is a Payment Link Generator?

- When Should You Use a Payment Link Generator?

- How Does a Payment Link Generator Work?

- Benefits of Using a Payment Link Generator for an eCommerce Business

- How to Create Payment Links Using a Payment Link Generator?

- What to Look for in a Payment Link Generator?

- Looking for a Payment Link Generator?

What is a Payment Link Generator?

A payment link generator generates unique, shareable links, extending the checkout to consumers and enabling them to make payments at their convenience. These links can be used effectively to bundle personalised offers for consumers to complete the purchase.

For example, Nimbbl’s payment link generator allows you to generate custom payment links that continue your brand identity for various payment methods, such as credit/debit cards, UPI, digital wallets, BNPL, and net banking. You can generate the link without coding and share it across SMS, email, WhatsApp, and Messenger.

When Should You Use a Payment Link Generator?

Small business owners without a store website who mostly rely on WhatsApp, Facebook Messenger, or Instagram

Suppose you don’t have enough budget to build a complicated eCommerce website, or you are in the process of creating one. In the meantime, you are selling your products through WhatsApp, Facebook Business, or Instagram shops.

In this case, Cash On Delivery (COD) is not the best way to collect payment because of high return rates. Instead, a payment link generator helps you generate customised payment links for each transaction without a proper website setup.

🔖Want to know more about why COD isn’t the best option for eCommerce merchants? Read: What are Prepaid orders?

Small to mid-market businesses primarily using SMS marketing

Another great way to leverage a payment link generator is for collecting payments through SMS.

Suppose your business primarily functions on SMS marketing, and you have a long list of users who receive product recommendations and SALE notifications through SMS. In that case, using a payment link generator to request payment directly for an optimised payment process makes sense.

Brick-and-mortar stores slowly adapting to digital payment methods

Consider your neighbourhood retail store that’s taking baby steps toward payment collection through digital channels. Since many of its audiences still prefer cash payments, the transition to BNPL and credit cards cannot happen overnight.

On the other hand, the store needs to keep up with the young population who prefer new-age payment methods like UPI. In fact, as of January 2025, 641 banks are live on the UPI ecosystem. And in January 2025 alone, UPI transactions surpassed 16.99 billion with a value exceeding ₹23.48 lakh crore.

Therefore, the best approach for retailers is to strike a balance between modern and traditional payment methods. That’s why opting for the pay-by-link option is most convenient. Payment links make transactions easier for everyone—from boomers and generations before them to even the younger generations.

Small and medium-sized online stores with a segmented customer base selling through multiple channels

Suppose you have an eCommerce store running on a multi-channel model. That means your online store isn’t the only revenue-generating store. You’ve multiple income sources, such as emails and newsletters, social media platforms, blogs, etc.

In that case, you have segmented customer bases. Here, instead of trying out multiple payment modes, it is a good idea to focus on a uniform payment mode that’s accessible to all users. Hence, using payment link generators to generate shareable links for payment collection is your best bet.

NGOs and Non-profits raising donations

Payment links are the most convenient method when accepting donations or raising funds for a charitable cause. Getting people to donate is a tough job, and even with little inconvenience in the payment flow, they are expected to leave without completing the transaction.

A payment link is a reliable and streamlined way of collecting donations without friction.

Service providers and consultants accepting payments

Individual service providers can use payment links as their sole payment request mode when collecting client payments. Without a payment link, the process of clearing an invoice is rather long:

you have to send an invoice, the organisation needs to add your account details as a beneficiary in their

- Send an invoice

- Provide bank account details to companies so they can add them to the beneficiary list (which can take some time)

Moreover, it may take 3-5 business days for service providers to receive their payment, as companies will manually process the payments each month.

On the flip side, if you send a payment link to your client, they can directly clear the payment using their preferred payment methods (credit cards or UPI), and the process will be faster and instantaneous.

For example, therapists, nutritionists, marketing consultants, or freelancers in any industry can use payment links to avoid delayed payments. By using a payment link generator, they can send a direct payment request after project completion or at the end of the consultation. Thus, clients can instantly pay them via their preferred payment options like UPI, cards, or wallets. The best part is that they can track their payment statuses and get visibility into their payment status within a single dashboard.

Travel and hospitality companies

Travel and hospitality companies usually follow custom pricing models. To avoid the hassle of manually sending invoices to different clients, create customised payment links and share them through any preferred online channels so the clients can complete the payment at their convenience.

Event organisers selling tickets online or offline

If you’re an event organiser hosting workshops, webinars, or even local community events, payment links are beneficial to ensure a streamlined booking process. Instead of building a full ticketing website, you can generate unique payment links for different ticket tiers (Early Bird, Standard, VIP). You can share these links via WhatsApp groups, Facebook events, or email newsletters, making it easy for attendees to pay instantly and secure their spot.

Utility service providers that collect recurring payments

Coworking spaces, gyms, or internet providers usually operate on recurring billing. Instead of sending manual invoices every month, these businesses can create reusable payment links and share them with their customers on a set schedule. This way, they can simplify collections while giving customers flexibility to pay via UPI, cards, or BNPL.

With payment link generators like Nimbbl, they can even configure auto-reminders so customers never miss a payment renewal.

Educational institutions collecting admission or tuition fees on a monthly or quarterly basis

Schools, colleges, and coaching institutes often need to collect admission charges, exam fees, or tuition installments. Payment links make this process much faster by cutting down on bank transfers or cash deposits.

They can simply generate payment links, share them with students or guardians, and receive payment instantly. They can also track transactions and monitor dues in a single dashboard.

Social sellers, creators, and influencers monetising directly

Independent creators on Instagram, YouTube, or newsletters can use payment links to sell digital products (like eBooks, templates, checklists) or charge for one-time sessions (like workshops, paid webinars).

This allows them to skip the expense of setting up a full eCommerce store while still offering a professional checkout experience.

Using payment link generators like Nimbbl, they can also offer multiple payment methods that cater to a wide audience with ease.

How Does a Payment Link Generator Work?

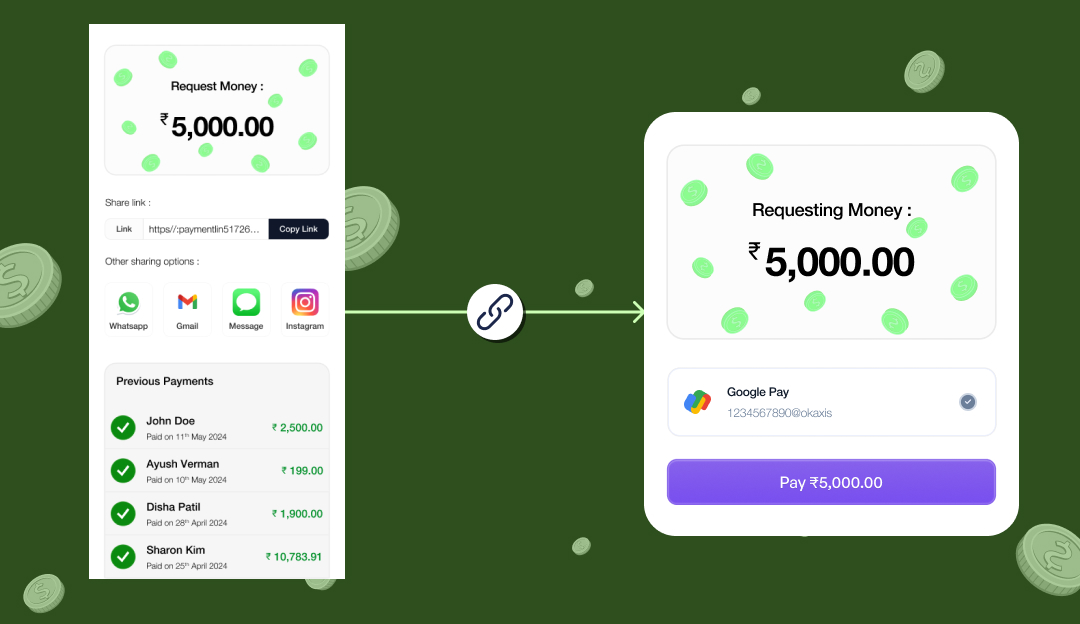

Below is the working process of a payment link generator:

Step 1: The merchant’s server requests for a payment link

Step 2: The payment link generator creates the payment link based on their request

For instance, Nimbbl creates unique payment links using the dashboard and APIs. It allows you to set the amount, link expiry time, and other customisations.

Step 3: The merchant receives it and shares the payment link with the customer

Step 4: The customer receives and clicks on the online payment link

Step 5: The payment generator redirects the customer to the payment page

Step 6: Customer submits their payment details to complete a one-click checkout

Step 7: The payment link generator processes the payment and shows a “Payment Succesful” message on the screen

Step 8: The merchant receives a payment confirmation notification

Benefits of Using a Payment Link Generator for an eCommerce Business

But why should you use a payment link generator in the first place? Well, here are the benefits of using a payment link generator:

Reduce cart abandonment rate

The biggest advantage of payment links is that users don’t have to return to your online store every time to complete a transaction. If a user abandons their cart, you can directly share the payment link with them through a cart recovery email or SMS, requesting they complete their purchase. This increases customers’ convenience, and they complete a payment transaction sooner.

Streamline and optimise your payment process

Payment links have high accessibility as you can share payment links with your customers through their preferred communication channels. Once customers click on a payment link, it redirects them to their preferred payment method to create an optimised payment experience. Setting up a payment link using any payment generator is a zero-hustle process where you just have to fill out details like the amount, customer contact number, etc., and that’s all.

Shift towards cashless transactions

If you want to expand cross-border, relying on a particular currency is not the best idea. India is also shifting towards becoming a cashless economy, and it’s high time merchants tried out different digital payment methods to find the most suitable one. When discussing online payment methods, payment links are hands down the easiest starting point.

Faster payments and improved cash flow

Payment links significantly speed up the payment process. Customers can complete transactions immediately, eliminating manual invoicing and payment delays. Additionally, with India’s growing digital transactions ( 34.8% increase in digital payment volumes), payment links are a viable option for businesses, as they offer multiple payment methods, stabilize cash flow, and reduce operational tasks.

Highly customisable for segmented offers and personalisation

Payment links allow you to tailor payment pages for specific audiences. You can customise for campaign-based offers, customer segments, or special promotions. You can also add branding elements, pre-fill amounts, and craft dedicated messaging, making each payment experience personalised and aligned with your marketing. This flexibility helps boost conversions and build brand credibility.

How to Create Payment Links Using a Payment Link Generator?

Creating a payment link is relatively simple once you have selected the apt payment link generator or payment gateway.

Below are the steps:

Step 1: Integrate the payment gateway with your eCommerce platform. You can find their built-in marketplace or connect via an API.

Step 2: Sign up for your desired payment gateway and provide all the necessary details to complete the initial verification.

Step 3: Go to the dashboard and find the payment link generator. Add the required details, such as the amount, payment method(s), link expiration time, etc.

Step 4: Now click the “Generate” or “Create” button, and your payment link is ready. Share it with your customers through social media, messaging, or email. You can even add it to your website. Some payment link generators allow you to configure auto reminders for recurring payments.

Step 5: The customer will now complete the payment. If your payment link generator supports one-click checkout and optimises the payment experience by showcasing the eligible payment methods for customers, that’s extra special. Customers won’t need to remember OTPs or UPI IDs, as checkout only takes a click.

Step 6: Any good payment link generator has an intuitive dashboard to track payments and quickly access customer details.

What to Look for in a Payment Link Generator?

There is no right or wrong when selecting a payment link generator. Instead, focus on the features you want it to support.

Below are some of the key features to look for in a payment link generator:

- Intuitive dashboard to track payments: There should be a standard dashboard where you monitor the transactions and expired payment links and send auto-reminders to the customers who didn’t complete the checkout. The sender should see whether the payment link has been delivered or paid. Brownie points if you can manage or edit your payment links to configure offers

- Supporting multiple payment methods: It should be compatible with all the latest digital payment methods like UPI, BNPL, Credit/Debit cards, digital wallets, and net banking

- PCI-DSS compliance: The payment link generator should be compliant with the Payment Card Industry Data Security Standard (PCI-DSS) and use encryption to protect sensitive data

- Intelligent payment routing and payment optimisation: Brownie points if your payment link generator comes with an intelligent payment router that routes customers to their eligible payment route to complete a checkout faster and creates an optimised checkout experience with a one-click checkout

- Hassle-free integration with your eCommerce platform: No matter which eCommerce platform you use or choose to use when your store is ready to operate, make sure that the payment link generator integrates seamlessly with it, and there’s no long checkout process

Looking for a Payment Link Generator?

Try Nimbbl.

Are you in search of a payment link generator that:

- Generates sharable payment links within seconds

- Supports multiple payment methods

- It has built-in one-click checkout and payment router to make the payment process hassle-free

- It comes with a built-in dashboard to track multiple payment statuses

- Compatible with all leading eCommerce platforms like Shopify, Wix, WooCommerce, Magento and so on

We have the perfect solution for you: Nimbbl Payment Link Generator.

Want to try it first-hand?