As of March 2025, UPI was the most used digital payment mode in India, with a volume of around 185 billion transactions. Therefore, it’s a no-brainer to have UPI as one of your business’s payment options

Without UPI, collecting payments can be tricky. Customers may step back from providing their bank details or enter incorrect card numbers, resulting in declined payments and cart abandonment.

Additionally, if you don’t offer UPI, customers may opt for cash on delivery, which means increased operational expenses and staggered cash flow.

So, if you’re yet to adopt or offer UPI to your customers, it’s time you learn everything about it and give it a try. This blog post explains what UPI is, how it works, its benefits and challenges, and even the latest features and security updates.

Content Index:

- What is UPI?

- History of UPI

- Why is UPI revolutionary?

- What is UPI ID or VPA?

- What is UPI PIN?

- Features and benefits of UPI

- Working with UPI

- How to register with UPI-enabled applications?

- UPI feature apps in India

- Banks that provide UPI in India

- Upcoming advancements in UPI

- UPI for Business

- Benefits of Magik UPI

- Magik UPI – Working

- FAQs

What is UPI?

UPI, or Unified Payments Interface, is an instant, real-time fund transfer method that allows you to send or receive money to peers or businesses without exposing your bank details. It links multiple bank accounts to one platform and facilitates inter-bank transactions through smartphones.

The National Payments Corporation of India (NPCI) regulates UPI and sets the regulations and guidelines for its operation. It is the primary body governing daily UPI operations. However, the Reserve Bank of India (RBI) also plays a regulatory role in monitoring UPI transactions.

The UPI payment system runs on these crucial components:

UPI ID or VPA

A UPI ID or VPA (Virtual Payment Address) is a unique address associated with a user linked to their UPI account. The address links to their bank account but differs from their bank account number. Anyone can send or receive money without exposing their personal or bank account details using a UPI ID.

Your UPI ID can look like xyz@okbank, where ‘xyz’ is the prefix—your name, mobile number, or the first half of your email ID, and @okbank refers to your bank. It is usually your bank’s initials or name—for instance, xyz@oksbi or xyz @okaxis. Therefore, in a UPI ID like ‘janedoe@oksbi’, ‘janedoe’ refers to the person’s name. It can also be their email ID or mobile number.

UPI PIN

UPI PIN is a unique digit combination required to authorise payments. The first time you connect your bank account to a UPI app, like PhonePe or Google Pay, you’re prompted to create a unique UPI PIN.

Now, you must enter this PIN every time you perform a transaction or add a new payment account. You can also change UPI PINs periodically to reduce the risk of unauthorised access.

The knowledge gap about UPI needs to be filled

Why is UPI a Better Alternative to Cash and Card Payments?

UPI is one of the most convenient solutions for addressing Cash on Delivery (COD) issues. It eliminates the need for customers to provide an exact amount or rush to the ATM. UPI ensures immediate cash flow for eCommerce businesses and reduces operational expenses such as cash handling, counting, and transportation.

UPI is also a better alternative to card payments and net banking. Here’s why:

Cost-effective

UPI saves you the cost of purchasing an EFTPOS (Electronic Funds Transfer at Point of Sale) machine to receive payments. Plus, you don’t need to pay card processing fees. You can use a QR code to collect payments from customers.

Quick setup

Setting up UPI is straightforward compared to card and net banking. You must fill out minimal details and set a PIN to receive and send money. Moreover, customers can pay you without your bank account number, IFSC (Indian Financial System Code), or branch details.

Wider accessibility to customers

With UPI, your business becomes more accessible to customers without cards or extensive banking information. It offers seamless one-click checkout, making shopping more convenient. UPI also reduces the chances of transaction failure, which is common in card payments if customers fill out the wrong card details.

What are the Features and Benefits of UPI?

According to the latest statistics, UPI dominates the Indian payment landscape. As of October 2024, UPI processed ₹23.49 Lakh Crores across 16.58 billion financial transactions, marking a 45% year-on-year growth. And the credit goes to its easy-to-use features and multiple benefits. Here’s a quick rundown:

- UPI enables instant real-time money transmission using a mobile device around the clock every single day of the year.

- It simplifies accessing several bank accounts with a single mobile application.

- Pull and Push payments, using the client’s virtual address, provide an additional layer of protection since the consumer does not need to provide sensitive information such as their credit card number, bank account number, or IFSC code, among other things.

- It lets you quickly check your account balance by entering your UPI PIN.

- It allows you to set recurring payments for subscriptions, bills, etc., with the AutoPay feature.

- Make payments through your IVR number, missed call, App functionality on feature phones, and sound-based technology with the UPI 123PAY feature. It is beneficial for users with limited or no internet connectivity.

Latest UPI Feature Updates 2025

UPI features constantly evolve to ensure seamless processing, enhanced security, and quick transfers. Here are the updated UPI features to date:

UPI Delegated Payments

This feature, also known as the UPI Circle, allows multiple users (up to 5) to transact from a single primary bank account. The primary account can authorise a secondary user to make payments using their account within a set limit—up to ₹5000 per transaction or ₹15000 per month.

- If you set partial delegation, the secondary user can initiate transactions, but the primary user must approve and enter the PIN. This allows more control and better security.

- If you set full delegation, the secondary user can independently transfer funds within the set limits.

This feature is particularly beneficial for expanding the use of UPI in rural areas with limited digital literacy. It is also helpful in introducing children and senior citizens to digital payments and delegating expenses to trusted business staff and caregivers.

UPI transaction limit

According to NCPI, the UPI transaction limit is up to ₹1 lakh per transaction. However, the transaction limit is up to ₹2 lakhs for a few specific transaction categories, like Capital Markets, Collections, Insurance, and Foreign Inward Remittances. The limit for Retail Direct Scheme and Initial Public Offering is ₹5 lakhs.

Auto Top-Up on UPI Lite

Launched on 31st October 2024, this feature allows you to automatically top up your balance UPI Lite when it falls below a set threshold. If you use UPI Lite for your daily business expenses, this feature can be beneficial as it ensures a sufficient wallet balance without manual recharge hassles.

UPI Deemed Acceptance for P2M transactions

Effective June 30, 2025, this feature will automatically consider certain UPI payments to merchants (Person-to-Merchant) successful even if the merchant’s system doesn’t confirm.

For instance, when a customer pays you, the amount gets deducted from their account. But sometimes, due to technical issues on your bank’s side, they don’t receive a confirmation. With Deemed Acceptance, the transaction will be considered successful if the money leaves the customer’s account, but there’s no success message within a set time.

This ensures fewer customer complaints, faster settlements, and no unnecessary payment reversals.

API usage rules

Starting August 1st, 2025, NCPI is rolling out API usage rules, as per which PI apps and banks must implement rate limits on non-financial API requests. They must regulate autopay transactions as follows:

- Balance enquiries to be capped at 50 requests per user per app per day.

- Fetching linked bank account details will be limited to 5 requests per user per app per day.

- Transaction status checks will require at least 90 seconds of wait time after authentication. Only three checks will be allowed within a two-hour window per transaction.

- UPI autopay mandates will be executed outside peak hours (10 AM–1 PM and 5 PM–9:30 PM).

These rules will prevent overloads and ensure UPI’s reliability and stability during peak hours. (Source)

PF withdrawal via UPI

The Employees’ Provident Fund Organisation (EPFO) is set to integrate with NCPI to change how employees access their Provident Funds (PF). Starting June 2025, employees can withdraw their PF and instantly access funds up to ₹1 lakh. This feature will reduce processing times, eliminate the need for manual approvals, and help during emergencies. (Source)

Challenges of UPI

Now that you know the benefits and features of UPI, let’s look at the flipside—the potential challenges of using UPI.

- Payment failures: Since UPI relies on multiple banking and PSP systems, the chances of unsuccessful payments and pending transfers are high during peak hours. However, with the Deemed Acceptance feature, you can offer customers a better payment experience.

- Complex reconciliation: Reconciling transactions with multiple banks, apps, and UPI IDs can be difficult. You might need more backend automation to match orders and transactions.

- Dispute resolution: UPI doesn’t offer chargebacks like cards. In case of disputes, merchants have fewer options to reverse fraudulent claims. This involves contacting the bank, PSP, and the NCPI or RBI if the problem escalates.

How Safe is UPI?

There were 13.42 lakh UPI fraud cases in FY 2024, totalling a loss of ₹1087 crore. This suggests why a considerable number of people have yet to use UPI.

However, NCPI has implemented several features to make UPI transactions more secure. Other safety features are also upcoming and will reduce the number of UPI frauds.

- 2-Factor Authentication (2FA): Currently, UPI transactions require PIN, device verification, and authorisation from registered users. Further, you can use partial delegation to control the fund transfers if you have secondary users.

- End-to-end encryption: All your UPI transactions and messages are encrypted, which secures the data in transit.

- Fraud monitoring: NCPI uses machine learning and real-time risk scores to monitor transactions and prevent fraud.

- Device and SIM bound: If you’re not using UPI Circle, UPI transactions can be made only via the registered device and SIM.

Apart from these existing security features, there are a few more in the plans:

- Usage limits: While UPI has transaction limits, starting August 2025, there will be limits to balance inquiries, checking transaction status, and autopay retries. (Source)

- Biometric authentication: NCPI is in talks for implementing biometric authentication for UPI transactions, adding an extra layer of security to the UPI PIN. (Source)

- Payee name verification: From June 30th, UPI apps must use the receiver’s bank-registered name instead of nicknames or custom saved names. This way you’ll know whom you’re paying, making merchant and customer payments more secure (Source)

How does UPI work?

Understanding how UPI works is a step towards fully understanding it. You can request or make payments using just the UPI app, making money transfers extremely convenient.

Suppose you want to pay your vendor via UPI. Follow these steps:

- Select the option ‘Pay by UPI’ on the payment page.

- Follow the prompt and enter your preferred UPI ID / VPA in a text box.

- UPI ID is used to make or receive payments through any UPI-enabled app or platform.

- Once you have entered your UPI ID, you will get a notification on your bank app to make the payment.

- Review the details on the app’s pre-confirmation screen to ensure that the UPI details are entered correctly. Once you have confirmed the details, make the transaction.

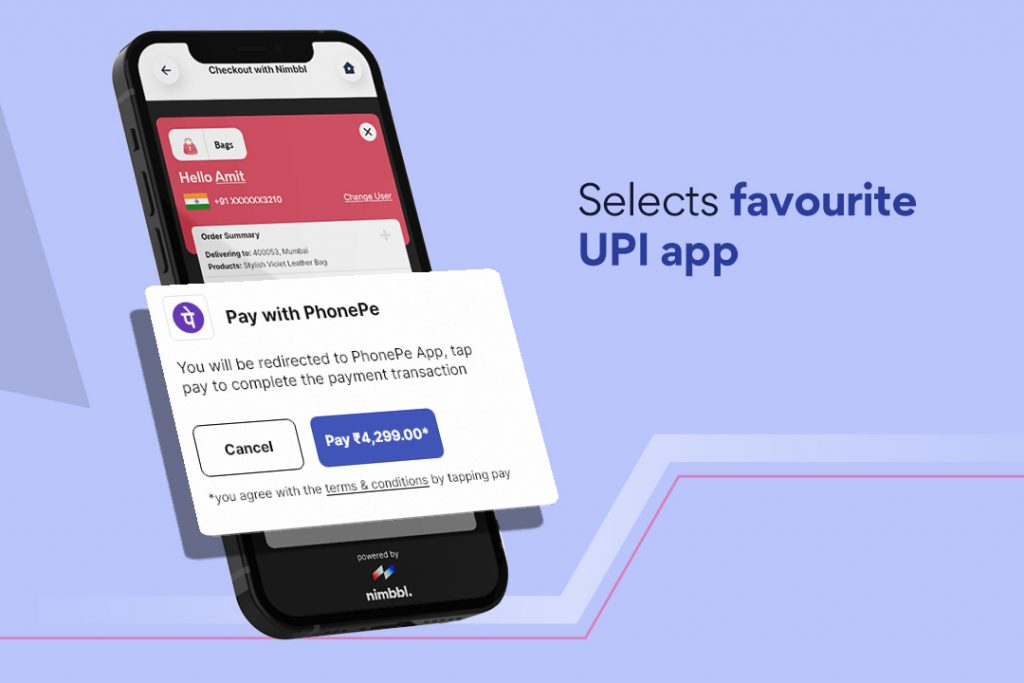

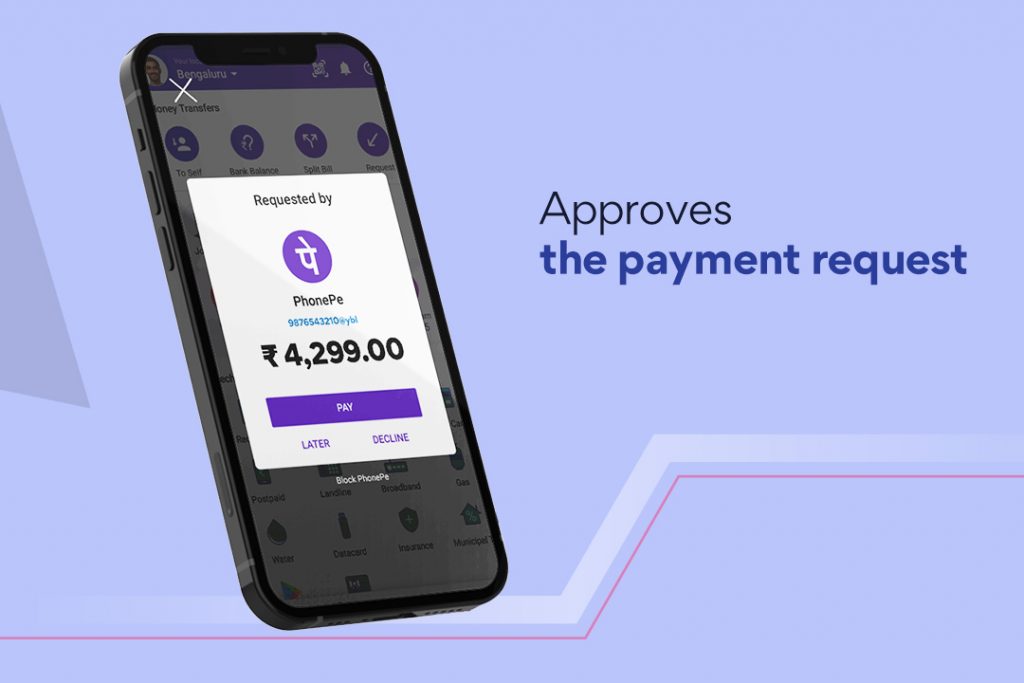

With Nimbbl’s Magik UPI, the hassles of entering or remembering your UPI ID are taken away. It is a feature that enables faster payments and higher conversions. Read more on Magik UPI in the latter part of this article. Here’s the Magik UPI flow:

How to register with UPI-enabled applications?

You can install your bank’s UPI-enabled app from Google Play Store, App Store, or your bank’s website.

- When you create a profile, you must provide your name and email address and set a new PIN.

- Linking your UPI account to your bank account can be done using the “Add/Link/Manage Bank Account” option.

Step 1: Generating UPI PIN

- Enter your bank account information into an online form to begin generating the PIN required for payment.

- Then the user clicks one of the options given.

Step 2: Generating and Changing M-PIN

- The issuer bank sends an OTP to the user’s registered mobile phone.

- The user must now enter their debit card number and expiry date.

- To create a new UPI PIN, the user must first input the OTP and then type in their selected numeric UPI PIN.

- Notifications about pin generation are sent to the consumer.

UPI feature apps in India

Google Pay

Google has always been a leader in technological advancement and operational effectiveness. NFC, or Near Field Communication, is a key component of Google Pay, making it the most popular app for this purpose.

PhonePe

For the first time in India, PhonePe, which Flipkart later acquired, offers UPI-based payment processing. It allows users to transfer money, recharge phones, pay rent and bills, purchase brand vouchers, and even invest.

Paytm

Paytm is India’s most popular digital payment app, available on both Android and iOS devices. It creates a Paytm Payment Bank account after completing KYC verification. These accounts do not require minimum balance and offers features like UPI transfers, cashback offers, and digital debit cards.

CRED

CCRED Pay is a partnership between CRED and RazorPay. It can be used for one-click payment and repeat purchases. CRED offers coins and cashback which can be used to buy products and pay credit card bills.

BHIM

BHIM or Bharat Interface for Money is the official UPI app developed by the NPCI itself. The app has a simple design and user interface. Fund transfer can be done using VPA, bank account number, QR code, or IFSC code.

Amazon Pay

Even though the UPI feature in the Amazon app was launched recently, it is quite popular. Any Amazon ID user can pay to external websites and merchants. They can also use it to make payments on the Amazon app with easy installment options. It is easy for Amazon merchants and shoppers to send and receive payments.

Banks that Provide UPI In India

All major banks in India support UPI. Let’s take a look at them –

- State Bank Of India

- HDFC Bank Ltd.

- Bank of Baroda

- Union Bank Of India

- Punjab National Bank

- Kotak Mahindra Bank

- Axis Bank Ltd.

- Canara Bank

- ICICI Bank Ltd.

- Bank Of India

Read the entire list at the NPCI site.

UPI for Businesses

UPI is an essential platform for businesses that wish to make and receive payments without the problem of multiple logins. As we’ve already mentioned the benefits of UPI payments for business, let us talk in detail about how Nimbbl Magik UPI offers a solution to UPI payment-related obstacles. Here’s a brief look at a few of them:

- Some users may not be fully familiar with UPI yet. Hence, they are unsure if they indeed have a UPI ID.

- Consequently, users may have to sift through several apps to find their UPI ID.

- Moving away from the payment page to switch to a UPI-enabled app may result in payment failure and losing the shopping cart items.

- eCommerce sites usually have a payment and checkout timer. Another significant problem is elapsing this checkout time and dropping off the site. The latter can also happen due to accidentally shutting down the browser, refreshing the page, or entering the incorrect UPI ID.

- The above payment issues result in a loss of revenue for enterprise owners.

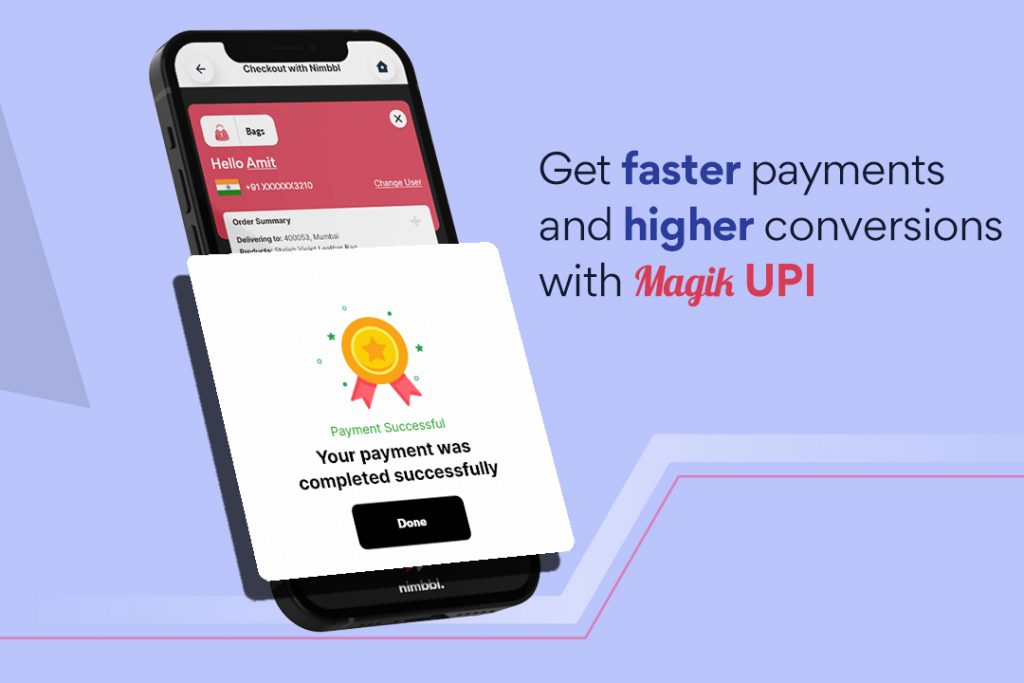

The solution is Nimbbl Magik UPI, for faster UPI transactions without any customer inputs.

How Magik UPI benefits you?

- First and foremost, Magik UPI does not require new technology integration for customers pre-built with Nimbbl’s checkout or through APIs.

- It offers an app-like experience even on browser payments, with no effort required from the customer’s end.

- The interface prevents the customer’s common UPI issues, like accidental payment cancellations, closing the browser, or incorrect UPI ID entry.

- Magik UPI also significantly reduces the payment time to a few seconds. This bypasses common pitfalls like customers changing their minds about using your website due to a lengthy transaction period.

How does Magik UPI work?

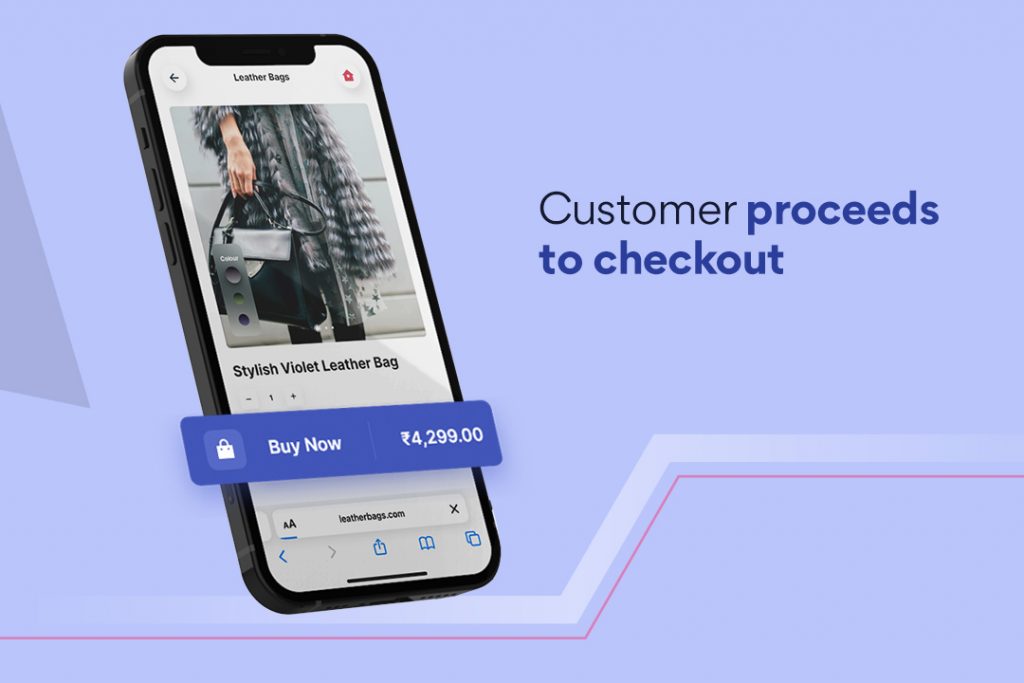

Magik UPI is a supremely handy UPI feature that benefits online businesses by offering universal UPI support with top UPI apps along with a 1-Click Checkout. These are the three simple steps involved:

- Customers land on the checkout page, they are presented with their UPI IDs.

- They can choose one UPI ID to complete the payment.

- They approve the payment using their UPI app.

With Magik UPI, businesses can experience the following benefits:

- Enhanced User Experience: Users can finalise purchases without recalling their UPI identifiers, simplifying the payment workflow

- Increased Transaction Success: Nimbbl Magik UPI boosts successful transaction rates by minimising errors in UPI ID input and reducing the likelihood of accidentally terminating transactions

- Refined Conversion Process: The platform is engineered to maximize conversions, enabling businesses to leverage a frictionless payment experience without the need for complex technical implementations or modifications

Final Words

UPI has gained a lot of popularity in the past few years. What started as a part of the Green Initiative has now become a popular and convenient payment mode. No wonder that the benefits of UPI payments have attracted many entrepreneurs and common people towards it. Today, UPI is the most convenient payment option which is why most customers use it to make payments. With all the leading banks and applications using UPI, it is important you understand UPI, its technicalities, and the best way to integrate it into your business. It will help you make payment experience more seamless and be accessible to a wider customer base.

FAQs

UPI is an initiative by the National Payments Corporation of India (NPCI), the Indian Banks Association, and the Reserve Bank of India.

Based on the latest data, UPI’s success in India is remarkable. Finance Minister Nirmala Sitharaman reported that in fiscal year 2024, India recorded about 131 billion UPI transactions worth approximately ₹200 trillion. This marks a significant increase from the previous year’s 83.7 crore transactions valued at ₹139 trillion.

The widespread adoption extends to rural areas, with Sitharaman emphasizing that “ordinary citizens” are using UPI, not just big businesses. This rapid transaction volume and value growth demonstrates UPI’s deep integration into India’s digital payment ecosystem. The system’s popularity across a broad spectrum of the population indicates its continued expansion and acceptance throughout the country (Source of data) .

The National Payments Corporation of India (NPCI) sets a standard daily limit of ₹1 lakh for UPI transactions. Additionally, NPCI caps the number of UPI transactions at 20 per day. However, the maximum daily transfer limit may differ among banks, typically falling between ₹25,000 and ₹1 lakh.

UPI payments are secure like any other payment method. UPI payment platforms ask for users’ authentication through their unique UPI ID and UPI PIN. These IDs and PINs are set up by the user and must remain confidential.

UPI transactions are generally free for customers. However, for transactions above Rs. 2,000 made through Prepaid Payment Instruments (PPIs) like digital wallets, merchants pay an interchange fee of up to 1.1%. This fee varies by transaction type, ranging from 0.5% for fuel to 1.1% for insurance and mutual funds. Small merchants are exempt, and medium-sized merchants only pay for transactions over Rs. 2,000.

Yes, you can use UPI to pay your credit card bill. Visit your credit card application and pay using the attached UPI method linked to your bank. Alternatively, you can use CRED UPI or Amazon Pay UPI to pay your credit card bills. As you open CRED or Amazon Pay, you must navigate to the credit card bill section, select your credit card issuer from the list, choose UPI as your payment mode, and authorise the transaction. It’s that easy.